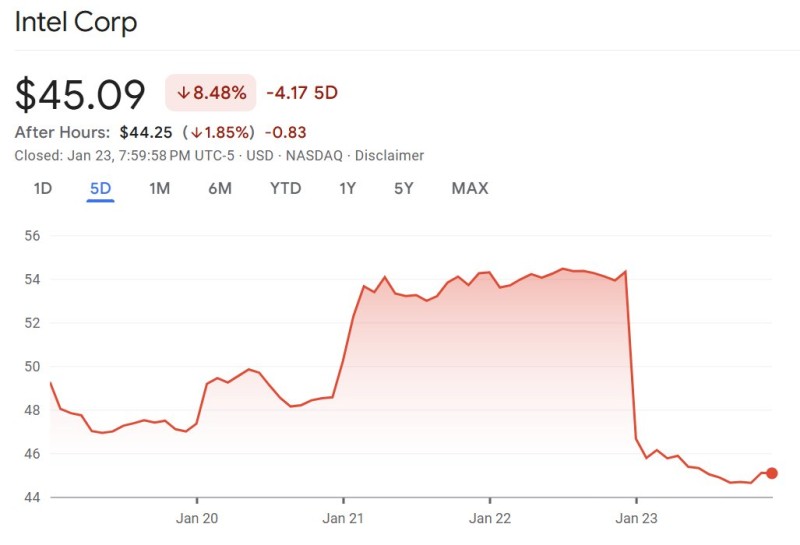

⬤ Intel Corp (INTC) took a beating in late-week trading after its push toward the mid-$50s ran out of steam. The stock got close to $55 before sellers stepped in hard, driving shares down to $45.09 by Friday's close—an 8.48 percent drop over five days. After-hours trading showed even more weakness as the selloff continued.

⬤ Intel had been climbing steadily through the week, working its way from the upper-$40s into the low-$50s. That momentum peaked around $55, which turned out to be a brick wall for the stock. Once that level failed to hold, the selling came fast. Thursday's session saw a particularly brutal drop that erased multiple days of gains in one go, showing just how quickly the tide turned.

⬤ The five-day chart tells the story clearly—Intel went from above $54 to the mid-$40s in no time. By Friday's close, shares settled around $45, then dipped further to roughly $44.25 in after-hours action, tacking on another 1.85 percent decline. That put the stock right back where it was earlier in the month, essentially undoing the entire rally.

⬤ For the chip sector, this matters. Intel's still a major player, and when a stock fails at a key level like $55, it tends to shake confidence across the board. The quick reversal shows how shaky these short-term rallies can be when they hit resistance—without strong follow-through, gains evaporate fast.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi