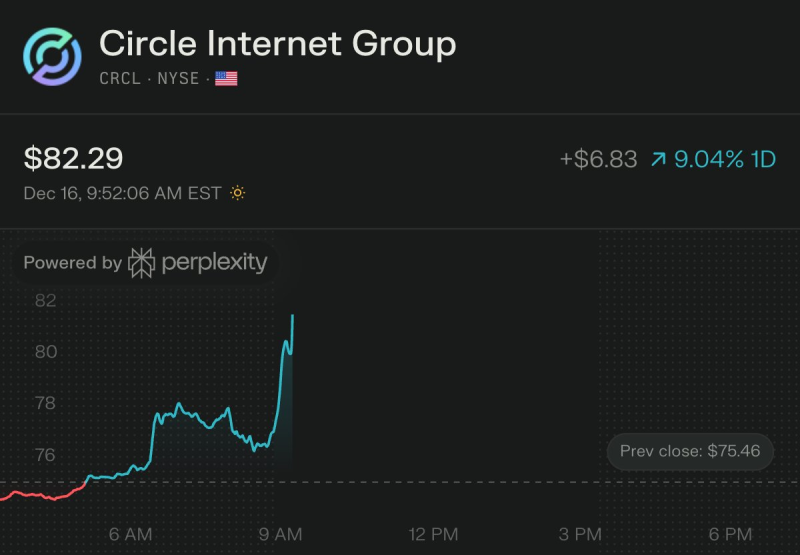

⬤ Circle Internet Group (CRCL) shares rose more than 9 % in one session moving from about $75.46 the night before to roughly $82, after Visa said it would let more partners settle payments in USDC, the dollar linked token managed by Circle. The card network told the market that any U.S. card issuer or acquirer may now close its books in USDC instead of dollars, a move that folds the token into everyday payment rails.

⬤ Cross River Bank besides Lead Bank will be the first to use the service running the transfers over the Solana chain. Visa intends to add other banks between now and 2026. When a bank opts in, it can bypass the normal fiat end-of-day wire and simply move USDC. Because Circle mints and redeems every USDC in circulation, wider use of the token inside large card networks flows straight back to the firm.

⬤ The share price jump shows that traders now treat stablecoin adoption inside regulated systems as a real business driver for token issuers. One day of trading was enough to lift CRCL by almost a tenth illustrating how fast payment related headlines re price digital-asset stocks. The endorsement also moves USDC's reputation past crypto trading venues and into the institutional payments toolbox.

⬤ The step is part of a wider pattern - large payment networks now treat blockchain based settlement as routine infrastructure. By wiring USDC into its clearing layer, Visa gives the token a formal role in bank-to-bank flows and it fixes Circle at the centre of the converging worlds of traditional and digital finance.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah