Few companies wield financial power like Apple does. Over the last ten years, the tech giant has quietly pulled off one of the biggest capital return programs in corporate history—repurchasing hundreds of billions of dollars' worth of its own shares.

The Numbers Behind the Buyback Machine

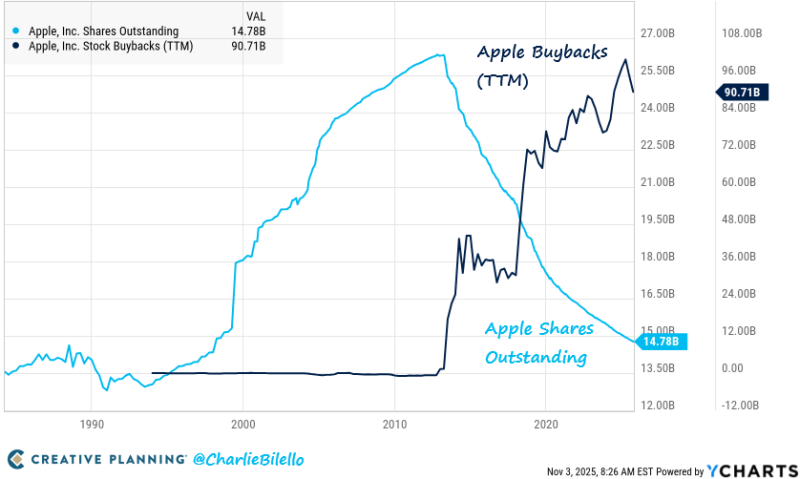

A chart shared by Charlie Bilello shows just how massive this effort has been: Apple's shares outstanding have dropped to multi-decade lows, while annual buybacks remain near all-time highs. The result? Apple has fundamentally reshaped its capital structure while rewarding shareholders on a scale that's hard to comprehend.

The chart tells a clear story. Apple's shares outstanding have fallen from around 26 billion in the early 2010s to just 14.78 billion today—a drop of more than 40%. At the same time, trailing 12-month buybacks have surged, topping $90 billion in the most recent fiscal year. As buybacks increase, share count shrinks—boosting earnings per share and increasing the value of each remaining stake.

To put this in perspective: Apple's $709 billion in repurchases over the past decade exceeds the market cap of 487 companies in the S&P 500. It's bigger than the GDP of many mid-sized countries. This isn't just financial engineering—it's a signal of confidence and a cornerstone of Apple's corporate identity.

What Makes It Possible

Apple's buyback power comes down to one thing: relentless cash flow. The company consistently generates over $100 billion in free cash flow each year, fueled by:

- Hardware dominance — iPhone, Mac, and wearables deliver predictable, high-margin revenue

- Services growth — Subscriptions, App Store fees, and digital payments create recurring income

- Cheap debt — Even in a higher-rate environment, Apple borrows at favorable terms to fund returns

With over $160 billion still sitting in cash and securities as of late 2025, Apple's buyback engine shows no signs of slowing down. It's not just supporting the stock price—it's reinforcing Apple's reputation as one of the most reliable wealth compounders in the world.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets