Two years ago, the stock cap of Apple Inc. first reached $ 1 trillion. However, in terms of the relative size of the company, it didn't really matter.

Despite Apple's place among its peers being beyond comparison in August, the entire industry had grown. As a result, their S&P 500 weightings are similar to those of past titans, including Exxon Mobil Corp. and IBM Corp.

Cap on the market, nearly $900 billion, shifting later: the stock exchange price of Apple is approaching uncertain waters. With its weighting in the S&P 500, which more than doubled since last August, Apple dethroned IBM and became the biggest in the last 40 years.

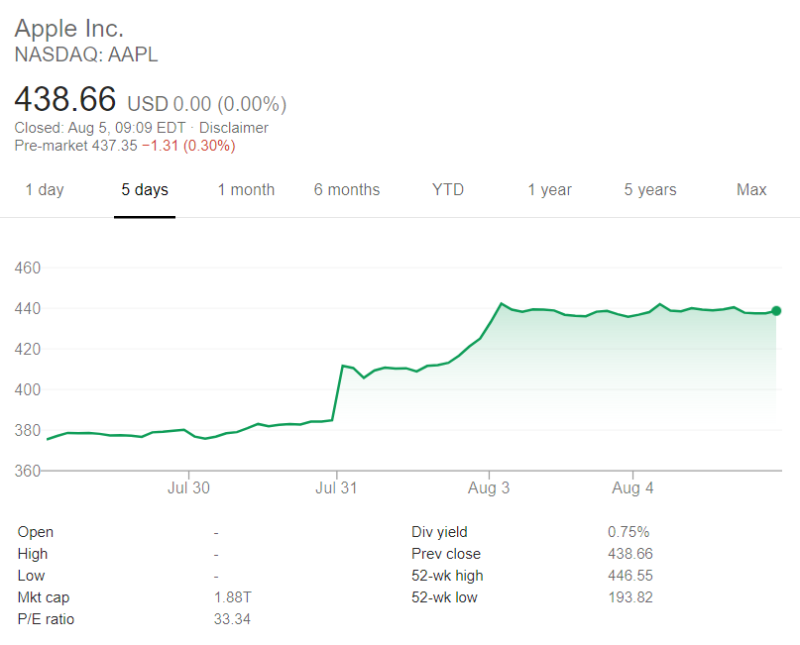

The S&P 500 share of the iPhone manufacturer has surpassed the six percent mark set by IBM 35 years ago, as it is indicated by the data from S&P Dow Jones Indices and Bloomberg. The current market cap for Apple is $1,875 trillion; around 7% from $2,000 trillion.

Market experts see the company's capitalization being at the level of $2 trillion in the nearest future. Tom Forte of D. A. Davidson & Co. estimates that the price per share will be $480 next year. This goal is 9.4% higher than the current one, which is where the $2 trillion capitalization mark is located.

In the past seven days, Apple's shares have risen by 18%. This is the highest increase since 2009. Apple added $570 billion to its capitalization, which is more than the total value of all companies in the S&P500 index, except for four.

Some industry analysts tend to wonder whether the rate of change is sustainable. The company sold 33 times its earnings at a 30% premium to the S&P 500, which is a higher than many have seen in the past 10 years.

Nonetheless, Apple's shares remain the most popular among ordinary investors, especially in the Robinhood app.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah