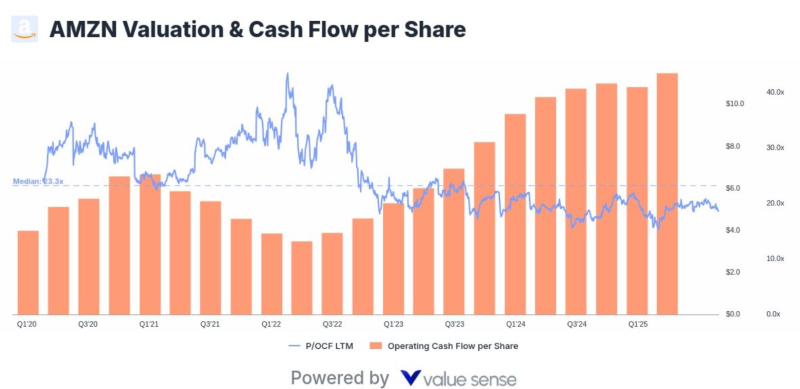

● According to a recent post by MMohamed11979, Amazon ($AMZN) looks undervalued compared to its track record. The stock's price-to-operating cash flow ratio sits at 18.7x—well below the 23.3x median it's held since early 2020. During that same period, operating cash flow per share jumped from $4.0 to $11.5, showing the company's impressive ability to generate cash even as its valuation stayed muted.

● There's a clear gap between Amazon's strengthening financials and how the market is pricing it. The company keeps delivering solid cash flow growth, yet investors remain cautious. Worries about the economy, softer consumer spending, and fierce competition in AI and cloud services are creating near-term headwinds that could keep the stock undervalued despite strong performance.

● Amazon's robust cash generation gives it room to invest heavily in AWS, AI infrastructure, and logistics while maintaining a solid balance sheet. If sentiment shifts, a return to the historical 23.3x valuation would mean roughly 25% upside from current levels. The company could also use its financial strength for share buybacks or strategic capital moves to boost shareholder returns.

● As MMohamed11979 notes, "$AMZN is casually trading below its median valuation multiples while growing operating cash flow per share." The chart backs this up—cash flow per share has climbed steadily since 2022 while valuation multiples stayed compressed.

● With improving efficiency, a strong cash engine, and growing AI exposure, Amazon may be one of the best long-term value plays among mega-cap tech stocks as markets refocus on profitability and fundamentals.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah