Amazon's stock has been on a wild ride lately, but something interesting just happened that has traders buzzing. After testing some crucial technical levels that had everyone nervous, AMZN pulled off exactly the kind of bounce that gets technical analysts excited. The stock found solid footing right where it needed to—at the intersection of two key moving averages that have been acting like a safety net.

What makes this bounce particularly intriguing isn't just where it happened, but how it happened. The swift rejection from lower levels suggests there's real buying interest lurking beneath the surface, and that could be setting the stage for something bigger.

Amazon (AMZN) Price Action Shows Strong Rebound

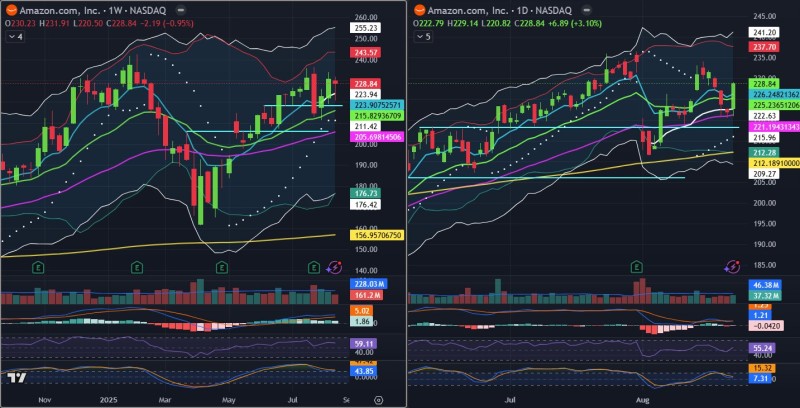

Amazon just threw bears a curveball with a textbook bounce off its Anchored VWAP and 21-day EMA—two levels that seasoned traders watch religiously. When a stock respects these technical markers this cleanly, it usually means something.

Trader @tommking7 caught this setup perfectly, noting how the bounce aligns with a broader shift in sentiment around big tech names. It's not just Amazon finding its footing; the entire Nasdaq structure is showing signs of life, and AMZN is riding that wave.

The timing couldn't be better. Just when it looked like the stock might crack under pressure, buyers stepped in with conviction. That's the kind of action that separates real support from fake-outs.

Bullish Technical Setup for AMZN Price

On August 22nd, Amazon closed at $228.84, up a solid 3.10% for the day. But here's what really matters: the stock hit an intraday low of $220.82 before rocketing to $229.14. That's a $8+ swing that shows serious buying power kicked in right at support.

The technical picture is getting pretty attractive:

- RSI sits at 55.24, showing momentum is building without being overbought

- MACD is flirting with a bullish crossover that could confirm the trend

- The 200-day moving average at $212 is holding like a fortress

Now traders are eyeing resistance at $237.70 and $243.57. If those levels crack, the next stop could be $255—a level that would put Amazon back in serious breakout territory.

Amazon Price Outlook: What's Next for AMZN?

Here's the deal: as long as Amazon stays above that $222-$215 sweet spot, the bulls are in control. A clean break above $235-$240 could unleash a proper rally toward $255, and that's when things get really interesting.

But let's be real—if support fails and we see a drop back to $212, that's where the real test begins. The 200-day moving average has been Amazon's last line of defense, and losing it would change the whole narrative.

For now though, the setup looks solid. Amazon's got the fundamentals (hello, AWS growth) and the technicals working in its favor. As long as those moving averages keep doing their job, this could be the start of something bigger.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah