Alphabet has experienced significant momentum recently, but current chart patterns suggest the stock is entering a consolidation phase. This cooling period, while maintaining the overall upward trajectory, presents interesting opportunities for swing traders looking to capitalize on technical setups.

Current Market Position

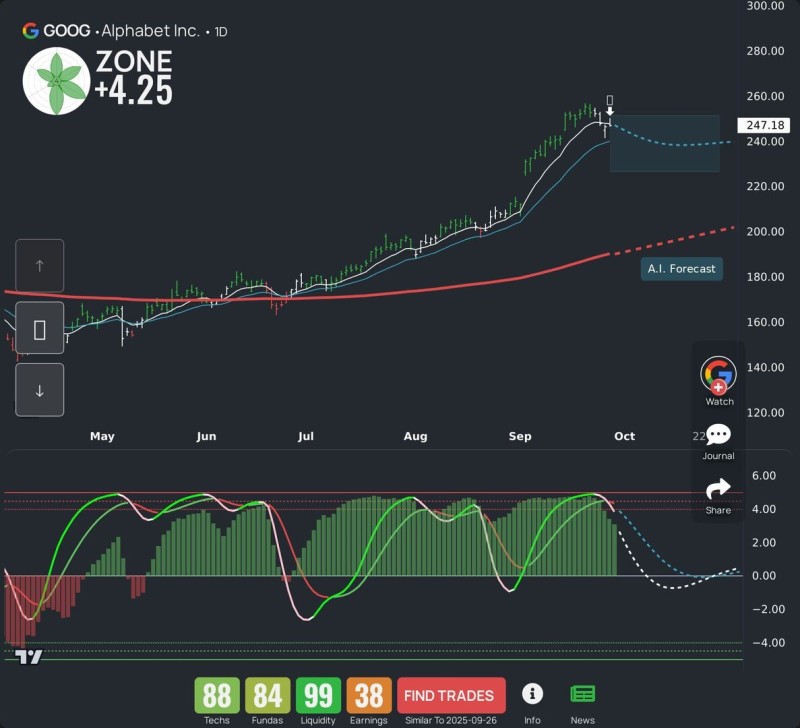

Following insights from WealthBranch's AI-powered LEAF analysis, Alphabet demonstrates strong fundamental positioning. The stock recently pulled back from peaks around $260 to current levels near $247. This retreat appears healthy rather than concerning, as key moving averages maintain their bullish alignment, suggesting the underlying trend remains robust.

Several important levels deserve attention in the current setup:

- Support Zone: The $240-$245 range represents a critical base level where buyers may step in

- Resistance Level: Previous highs near $260 mark the next significant hurdle for bulls

- Trend Structure: The 50-day moving average stays comfortably above the 200-day, preserving long-term bullish momentum

- Short-term Indicators: Momentum oscillators show signs of cooling, potentially setting up sideways action before the next upward move

This technical picture suggests Alphabet is digesting recent gains rather than experiencing a trend reversal.

Fundamental Strengths

Alphabet continues leading the AI revolution through its Gemini models and Google Cloud AI services. The company's advertising business remains strong while YouTube generates increasing engagement and revenue. Although regulatory challenges and competitive pressures exist, the fundamental story supports continued optimism.

Trading Perspective

The current consolidation creates an attractive setup for patient traders. If the $240 support zone holds firm, another push toward $260 and potentially higher levels becomes likely. Smart traders will wait for clear confirmation signals before committing capital, as this consolidation phase may offer the most strategic entry points.

Usman Salis

Usman Salis

Usman Salis

Usman Salis