Is This the End of the Recession?

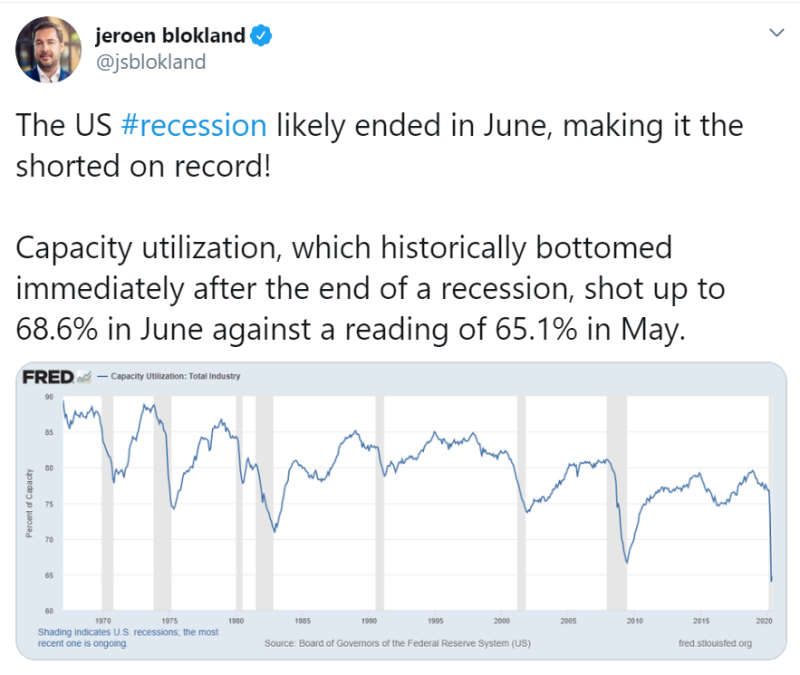

Jeroen Blokland, the Head of Robeco Asset Management, believes that the recession of the US economy ended in June, which makes it the shortest one in history. He bases his analysis on the value of the capacity utilization indicator published by the Federal Reserve.

This indicator reaches the bottom immediately after the recession and since it has increased from 65% to 68% in June, this gives a reason to believe that the recession is coming to an end, according to Mr. Blokland.

What is Capacity Utilization?

Capacity utilization implies the manufacturing capabilities that are being used by the enterprise. It is the proportion of the output produced now with given resources to the situation in which the enterprise’s capacity is fully utilized.

During recessions, demand drops significantly, which causes a response from manufacturers in the form of a decrease in output. This leads to a reduction in the number of employees and investment, which ultimately leads to a decrease in capacity utilization rate.

Other Signs of the Recession Being Over.

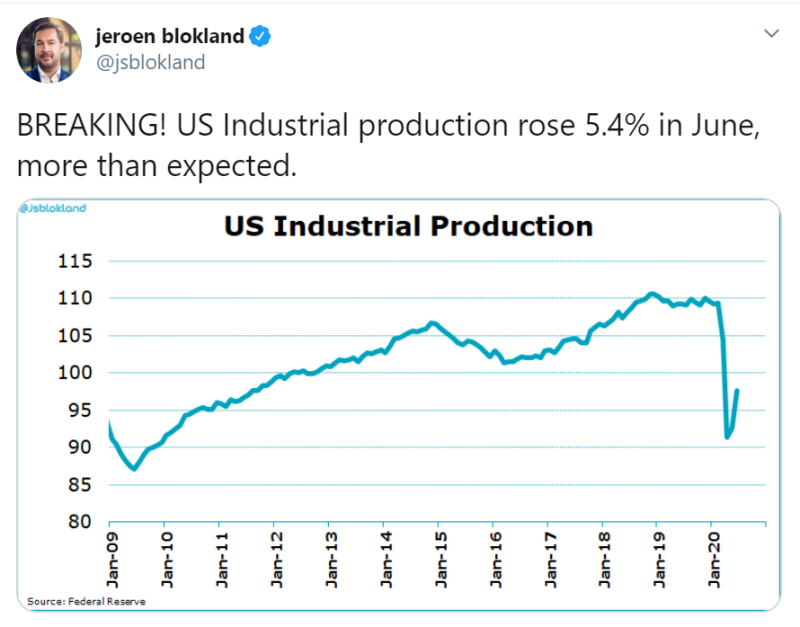

Mr. Blokland also reports an increase in industrial production in the United States in June.

The growth was equal to 5.4%, this value is higher than the forecasts, which may also be evidence that the recession in the economy has come to an end.

Opposite opinion

However, not everyone agrees with Mr. Blokland that the recession is over. Tuomas Malinen, s CEO of GnS Economics consultancy and an adjunct professor at the University of Helsinki, commented on Mr. Blokland’s tweet, noting that it is too early to draw such serious conclusions from the available data.

He believes that if certain economic indicators, for example, the unemployment rate, remain at the current level, it will not be possible to talk about the end of the recession since one cannot rely on data on economic growth only.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah