- Introduction

- Understanding White-Label Payment Gateway Technology

- Why Akurateco Leads the White-Label Payment Gateway Market

- Advanced Features for Modern Payment Processing

- Seamless Integration and Developer-Friendly Architecture

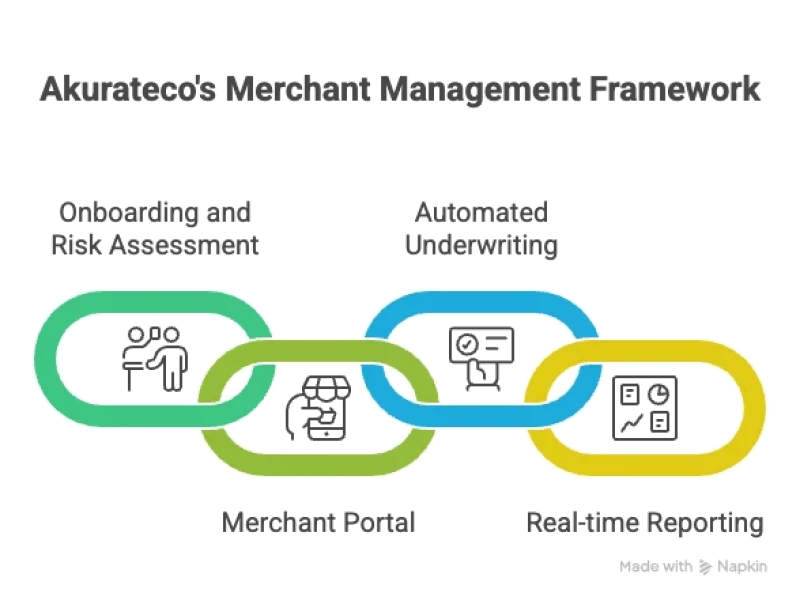

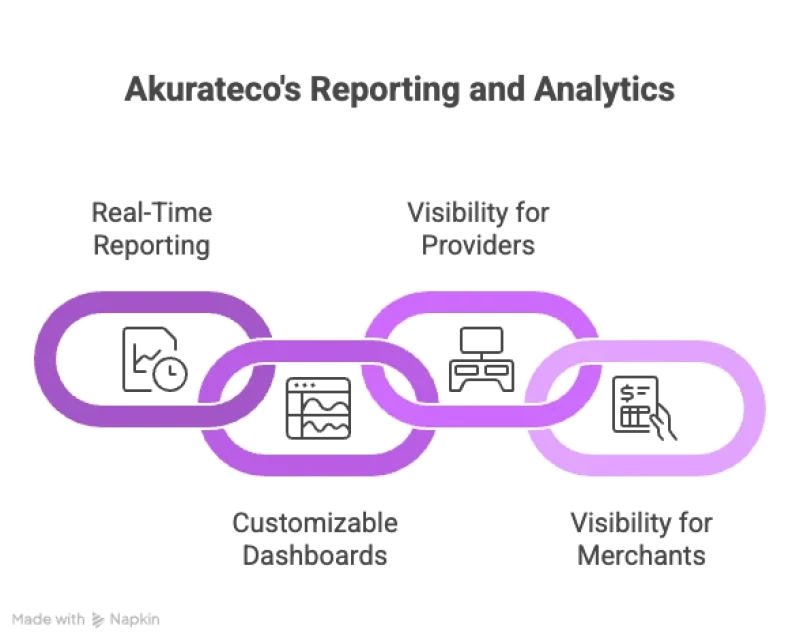

- Merchant Management and Onboarding Capabilities

- Payment Team as a Service

- Regulatory Compliance and Security Standards

- Scalability and Performance Optimization

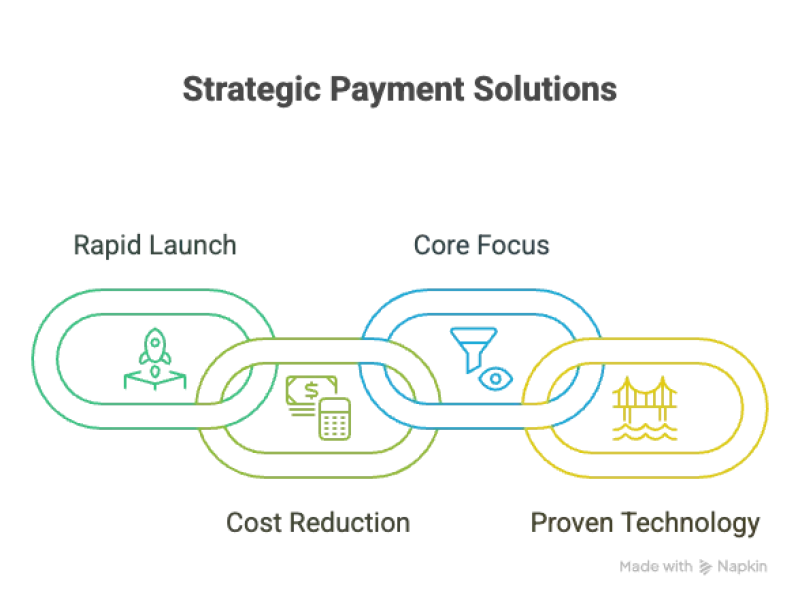

- Rapid Time to Market and Business Results

- Cost Structure and Return on Investment

- Customization and Brand Control

- Diverse Business Applications

- Proven Success Stories

- Conclusions

Introduction

The fintech landscape is evolving at breakneck speed, with payment processing at its core. For modern financial technology companies looking to offer seamless payment solutions without building infrastructure from scratch, white label payment processing has emerged as the strategic choice. These solutions enable fintechs to launch branded payment services quickly, reduce development costs, and focus on their core competencies while leveraging proven technology. Among the various providers in this space, Akurateco stands out as a comprehensive platform designed specifically for the unique needs of contemporary payment service providers, banks, acquirers, marketplaces, and online businesses.

Understanding White-Label Payment Gateway Technology

White-label payment gateways provide the technological backbone for processing transactions while allowing fintechs to maintain their brand identity. Unlike traditional payment solutions that require substantial capital investment and months of development, white-label platforms offer ready-made infrastructure that can be customized and deployed rapidly. This approach democratizes access to sophisticated payment technology, enabling startups and established companies alike to compete in the digital payments arena.

The technology encompasses everything from transaction processing and fraud prevention to merchant onboarding and reporting dashboards. For entrepreneurs exploring how to start a credit card processing company, white-label solutions eliminate the most significant barriers to entry, providing a turnkey platform that meets regulatory requirements and industry standards without the need to develop software from scratch.

Why Akurateco Leads the White-Label Payment Gateway Market

Akurateco has positioned itself as a premier choice for modern fintechs through its fully brandable white-label payment software and comprehensive feature set. The platform offers both cloud-based SaaS solutions and deployment on dedicated infrastructure or preferred cloud environments, giving businesses complete control over their payment infrastructure while maintaining scalability. This flexibility is particularly valuable for payment service providers that need to balance regulatory compliance requirements with rapid growth trajectories.

What sets Akurateco apart is its extensive network of payment integrations. The platform provides access to over 600 ready-to-use payment connectors, including trusted global names like Mastercard, Visa, Stripe, Google Pay, Apple Pay, Adyen, PayPal, PPRO, PayU, Flutterwave, Klarna, and Worldline. This eliminates the need for custom integration development, which typically requires significant investment, time, and technical expertise. The platform supports multiple payment methods, including credit and debit cards, alternative payment methods, and digital wallets, ensuring that fintechs can serve diverse customer bases across different markets.

With over 15 years of hands-on experience in online payments, Akurateco's leadership team brings deep industry knowledge that keeps payment flows running smoothly for clients worldwide.

Advanced Features for Modern Payment Processing

Akurateco's platform includes sophisticated intelligent routing capabilities that optimize transaction success rates through smart routing algorithms. These algorithms automatically direct transactions to the optimal service based on factors like transaction type, geographic location, and historical success rates. This intelligent routing not only improves authorization rates but also reduces processing costs by selecting the most cost-effective pathways. According to real-world results, PSPs using Akurateco have transformed their processing profile, increasing approval ratios from 49% to 69%, which directly translates to skyrocketing merchant revenue.

The platform's risk management and anti-fraud tools incorporate advanced security measures that protect merchants from fraud. Multi-layered security features include tokenization, third-party fraud prevention provider integrations, and customizable risk scoring systems. These features are essential for fintechs operating in high-risk industries or processing cross-border transactions where fraud risks are elevated.

Additional advanced features include recurring payments capabilities through smart tokens module, payment cascading for retry logic, and optimized checkout experiences that enhance conversion rates.

Seamless Integration and Developer-Friendly Architecture

Technical implementation is streamlined through Akurateco's robust API documentation and integration support. The platform provides comprehensive API documentation that integrates smoothly with existing fintech infrastructure, whether it's a mobile banking app, e-commerce platform, or subscription management system. Developers appreciate the well-documented endpoints and responsive technical support from dedicated account managers and tech experts that accelerates integration timelines.

The platform also offers a Mobile SDK for seamless integration into mobile applications, along with a connectivity box solution for enhanced payment processing capabilities. This extensive toolkit means fintechs can quickly expand their geographic reach and add new payment methods without negotiating individual partnerships or building custom integrations from scratch.

Merchant Management and Onboarding Capabilities

Akurateco provides comprehensive merchant management tools through its Merchant Management System that simplifies onboarding, risk assessment, and ongoing account monitoring. The platform's merchant portal allows payment service providers to manage their clients efficiently, with features for automated merchant onboarding, customizable workflows, and streamlined compliance processes. This automation can significantly reduce the time required to onboard new merchants while maintaining thorough due diligence.

Real-time comprehensive analytics give both payment service providers and their merchants visibility into transaction performance, settlement status, and financial metrics. Customizable dashboards can be white-labeled to match the fintech's branding, creating a cohesive experience for end users. The smart billing module enables PSPs to create sophisticated pricing models for their merchants, unlocking additional revenue streams beyond standard transaction fees.

Payment Team as a Service

One of Akurateco's unique value propositions is its Payment Team as a Service approach. Rather than requiring clients to maintain extensive in-house technical teams, Akurateco provides comprehensive support that encompasses all necessary roles and functions. This includes:

- Step-by-step guidance from dedicated account managers and tech experts to solve complex technical challenges

- Freeing internal teams to focus on business growth while Akurateco handles problem-solving and ongoing optimization

- Leveraging 15+ years of deep industry knowledge to keep payment flows running smoothly

This service model dramatically reduces the overhead associated with running a payment processing operation, as software development, infrastructure maintenance, and technical support are all handled by Akurateco's experienced team.

Regulatory Compliance and Security Standards

Operating in the payments industry requires adherence to stringent regulatory standards, and Akurateco's platform is built with compliance at its foundation. The solution maintains PCI DSS Level 1 certification, the highest level of payment card industry security standards, with built-in compliance for PCI DSS and other standards. This certification is crucial for fintechs, as it demonstrates to partners and customers that their payment infrastructure meets the most rigorous security requirements without undergoing the extensive months-long certification processes required when building from scratch.

Beyond PCI compliance, the platform supports regional regulatory requirements across different jurisdictions, enabling fintechs to expand internationally without rebuilding their payment infrastructure for each new market. The platform's security infrastructure protects sensitive cardholder data through multiple layers of protection.

Scalability and Performance Optimization

Modern fintechs need payment infrastructure that can scale from processing hundreds to millions of transactions without performance degradation. Akurateco's scalable architecture is designed to handle growth efficiently, automatically allocating resources during peak transaction periods. The platform maintains high performance even under heavy loads, ensuring that payment processing doesn't become a bottleneck as the business grows.

The consolidated data management system keeps all data in one place, providing easy-to-manipulate data management that keeps businesses in full control over data from various payment channels. This centralized approach simplifies reporting, reconciliation, and business intelligence activities.

Rapid Time to Market and Business Results

One of the most compelling advantages of Akurateco's white-label solution is the dramatically reduced time to market. While developing payment software from scratch can take months or even years, Akurateco enables PSPs to launch their platform in just two weeks. This rapid deployment allows businesses to bypass the hassle of payment software development entirely and start generating revenue almost immediately.

Real-world results demonstrate the platform's effectiveness. PSPs using Akurateco have increased their processing revenue from 92% to 95%, while simultaneously improving merchant approval ratios from 49% to 69%. These improvements directly impact the bottom line for both the payment service provider and their merchant clients.

Cost Structure and Return on Investment

The financial advantages of white-label solutions versus in-house development are substantial. Building payment software from scratch typically costs between $300,000 to over $500,000 for a highly advanced, fully customized enterprise payment orchestration platform. This includes developers' salaries, technology infrastructure, regulatory compliance costs, security measures, and ongoing system maintenance. Additionally, the demands for diverse teams for support, monitoring, fraud prevention, and account management create significant ongoing operational expenses.

In contrast, Akurateco's white-label solution operates on a cost-effective subscription model that scales with business needs, with customization costs generally ranging from $10,000 to $50,000 or more depending on specific requirements. The significantly reduced upfront investment, combined with all infrastructure costs included in transparent pricing, provides a clear path to profitability. All costs for infrastructure setup and maintenance are included, ensuring transparency and substantial savings compared to in-house development.

The return on investment extends beyond direct cost savings. With a two-week launch timeline versus months or years of development, fintechs can begin generating revenue immediately. The ability to focus internal teams on business growth rather than infrastructure maintenance creates substantial indirect value.

Customization and Brand Control

While white-label solutions provide pre-built functionality, Akurateco understands that modern fintechs need to differentiate themselves through unique user experiences. The platform offers extensive white-label capabilities and customizable payment pages that can be tailored to match the fintech's brand guidelines completely. This includes branded checkout experiences, merchant portals, and admin panels that can all be customized to reflect the client's brand identity.

The level of customization ensures that end users experience a seamless, branded journey without any indication that the underlying infrastructure is provided by a third party. For fintechs building their market position on brand strength and user experience, this capability is invaluable. Businesses can personalize their customers' checkout experience, allowing customers to use their preferred checkout method while leveraging Akurateco's infrastructure scaled to meet their expectations.

Diverse Business Applications

Akurateco's white-label platform is suitable for various business types, each with unique needs:

Payment Service Providers can launch and run their payment business with zero capital expenditures, with software development, infrastructure maintenance, and technical support handled by Akurateco.

Banks and Acquirers can serve their merchants efficiently with tools for merchant onboarding and compliance, customizable payment pages, settlements, anti-fraud measures, and third-party integrations.

Marketplaces and Platforms can embed financial services into their platforms using the scalable white-label solution, unlocking additional revenue streams from embedded payment facilitation.

Online Businesses and Merchants can expand to new markets, maximize revenue and approval ratios, and grow their business while Akurateco takes care of payment technology.

Proven Success Stories

Akurateco's effectiveness is demonstrated through numerous case studies with clients ranging from established banks to agile payment service providers. Notable examples include:

- Platon: Unlocking proprietary payment infrastructure for this prominent Eastern European PSP serving over 1,000 companies

- Dinero Pay: Transforming mobile payments in Saudi Arabia for this dynamic licensed payment service provider

- TESS Payments: Empowering this MENA payment service provider to scale and comply in Qatar's regulated market, trusted by Qatar Fintech Hub, Doha Bank, QNB, and QDB

- AzeriCard: Implementing Apple Pay and Google Pay for this leading Central Asian processing center certified by Visa and MasterCard

These case studies showcase how Akurateco partners with clients to build or refine payment systems that boost transaction approval rates, streamline payment flows, and elevate the end-user experience across diverse infrastructural needs.

Conclusions

Akurateco represents a compelling solution for modern fintechs seeking to deploy robust payment processing capabilities without the complexity, time, and cost of building proprietary infrastructure. The platform's combination of advanced features including intelligent routing, comprehensive analytics, smart billing, risk management, and recurring payments capabilities addresses the core needs of contemporary financial technology companies.

With over 600 payment integrations, PCI DSS Level 1 certification, and deployment flexibility through both SaaS and on-premise options, Akurateco provides everything needed to launch a competitive payment service in as little as two weeks. The Payment Team as a Service model ensures that clients receive ongoing expert support without maintaining large in-house technical teams.

By choosing Akurateco's white-label payment gateway solution, fintechs can accelerate their time to market, reduce capital requirements from hundreds of thousands to tens of thousands of dollars, and focus their resources on innovation and customer acquisition rather than infrastructure development. The platform's proven scalability, demonstrated through real-world success stories showing approval rate improvements from 49% to 69% and processing revenue increases from 92% to 95%, provides a foundation for sustainable growth across local and international markets.

For fintech leaders evaluating payment gateway solutions, Akurateco offers the technology, support, and flexibility needed to compete effectively in today's dynamic payments landscape while maintaining the brand control and customization options that drive competitive differentiation. Whether you're a payment service provider, bank, acquirer, marketplace, or online business, Akurateco's white-label platform provides the tools to transform payment operations and unlock new revenue opportunities.

Editorial staff

Editorial staff

Editorial staff

Editorial staff