Michael A. Gayed, a portfolio manager and an analyst, claims that it is not always wise to use only a technical analysis to assess situation on the market, as this can lead to lost profits.

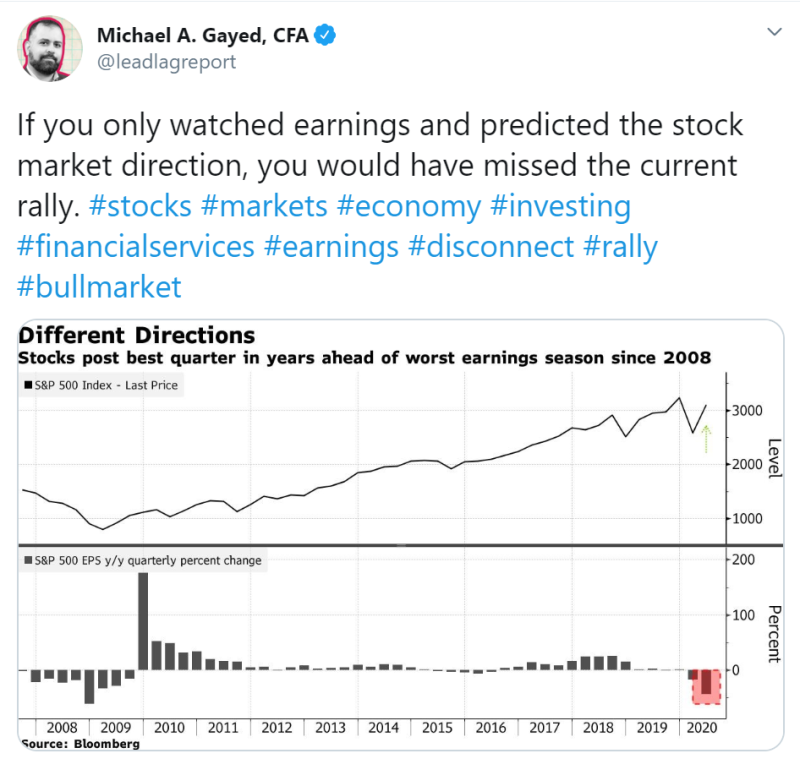

He estimates a large gap between the value of the S&P 500 Index and the EPS of the companies, which were included to Index.

According to all rules of a fundamental analysis, if a company has weak financial results in the first quarter, and forecasts for the second quarter are also not very promising, hence the company's shares should be cheaper. However, this does not happen, the S&P 500 Index continues to rise, recovering the fastest from the coronavirus-related decline.

During this unexpected rally, stocks of companies have been growing steadily, and the five largest technology companies have increased their market capitalization by $1.6 trillion since the beginning of the year, which is an incredible result.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah