- Toyota Motors Corp (Ticker: TM)

- Financial information

- General Motors (Ticker: GM)

- Financial information

- Honda Motor Corp (Ticker: HMC)

- Financial information

- Volkswagen AG (Ticker: VWAGY)

- Financial information

- Tesla (Ticker: TSLA)

- Financial information

- Douglas Dynamics (Ticker: PLOW)

- Financial information

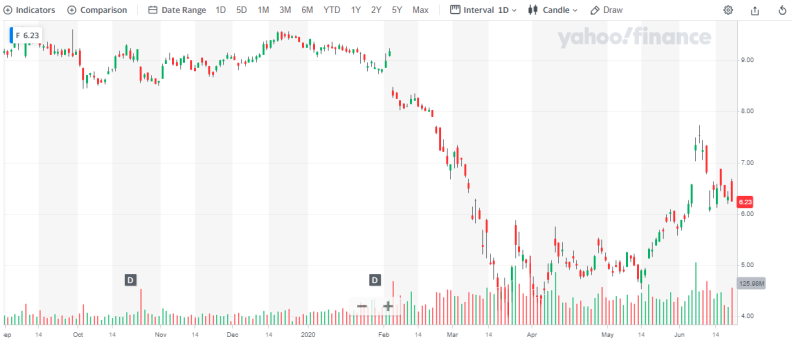

- Ford (Ticker: F)

- Financial information

- Nikola Motors (Ticker: NKLA)

- Financial information

- NIO (Ticker: NIO)

- Financial information

- Financial information

- Is it a good idea to invest in the car industry during this crisis?

If you think that the current crisis is not the best time for the automotive industry, you may change your opinion after finishing reading this article. We are going to show you ten car stocks that may have a great performance this year. The car industry is not in the best shape currently, but this is a good chance for investors to revise their portfolio and maybe add something from this promising industry.

Toyota Motors Corp (Ticker: TM)

This company is one of the best performing in the world. If you are looking for the best auto stocks in 2020, you can’t skip over this name. The company has seen great revenue growth in the past several years by reaching $30 trillion in 2019. This year Toyota seems to lose some of its positions, but it is still showing stable revenue growth figures slightly below $30 trillion.

As always, Toyota has serious innovation plans. The company invests in the development of electric cars and AI-powered self-driving vehicles. The dividend yield is 2.6%.

Financial information

Toyota stocks are considered to be close to its fair value by the Yahoo Finance value indicator. We can agree with that but the company may have some additional growth during the economic recovery.

- Market capitalization: 176.38 billion USD

- PE Ratio: 7.81

- EPS: 16.36

- Current Ratio: 1.04

General Motors (Ticker: GM)

This is a true giant of the automotive industry. The company had suffered a lot in the 2008 crisis but managed to survive. In 2020 we have seen another great GM stock collapse due to the current crisis. The main reason for this panic stock sales is the fear that the global economy will suffer more from the current situation.

However, there is one positive thing. The government is unlikely to let this automotive giant sink again. GM is not only a car producer but also a company which offers with a great number of jobs across the United States. If they fail, too many people will become a value in the unemployment data.

Financial information

General Motors stocks are considered to be undervalued by the Yahoo Finance fair price indicator and we can’t disagree with that by examining the chart. However, if you decide to invest in this company you need to be cautious as General Motors is currently going through hard times.

- Market capitalization: 38.052 billion USD

- PE Ratio: 8.15

- EPS: 3.26

- Current Ratio: 1.07

Honda Motor Corp (Ticker: HMC)

HMC is another Japanese automotive industry giant that seems to be undervalued by all the fundamental metrics. The company has reached 15.89 T revenue growth in 2019 but this year Honda Motor Corp is below this level. Anyway, the company is considered to be one of the best stocks in 2020. Moreover, the company has increased dividends' rate and is planning to buy part of its stocks back in 2020.

Financial information

Honda Motor Corp stock is considered to be undervalued by the Yahoo Finance fair price indicator. The company has a high potential in the post-crisis period and is likely to increase its revenue in the nearest future.

- Market capitalization: 45.948 billion USD

- PE Ratio: 4.62

- EPS: 5.79

- Current Ratio: 1.26

Volkswagen AG (Ticker: VWAGY)

This company is the second most valuable automotive firm on the planet. It is not surprising we have chosen it as one of the best stocks to watch in 2020. The company has increased its sales in China by 1.7% in 2019, which is currently the largest market. Overall sales have increased by 1.3%, which means that the company has increased in market share recently. It is worth to mention that Volkswagen includes such famous companies as Audi, Lamborghini, Ducati, Bugatti, Bently, and Porsche. The strategy to increase sales of higher-end brands works well as the global demand on the broader market decreases.

Financial information

Volkswagen AG stock price is increasing this year despite the crisis and the fears of investors. This shows the trust that investors have towards the company.

- Market capitalization: 78.437 billion USD

- PE Ratio: N/A

- EPS: N/A

- Current Ratio: N/A

Tesla (Ticker: TSLA)

Tesla has seen a great revenue growth rate in recent years, which is demonstrated on the chart. The list of the top car stock to watch in 2020 would not be completed without this company. Tesla shows impressive growth and its shares doubled in 2019. The company continues to invest and develop. The opening of Gigafactory in China allowed Tesla to reach a 100 billion capitalization level. Analysts predict the company to have 25% revenue growth in 2020.

Financial information

Tesla's stock price is considered to be overvalued as the company has just set a new ATH, which is clearly indicated on the chart. However, this may be just the beginning of new serious of tops as the company shows impressive revenue growth and this tendency is likely to continue this year.

- Market capitalization: 185.642 billion USD

- PE Ratio: N/A

- EPS: -0.81

- Current Ratio: 1.24

Douglas Dynamics (Ticker: PLOW)

This Milwaukee based company is not a car manufacturer. They are selling attachments to the trucks including plows, snow and ice equipment, and other truck “plugins”. The customer base of Douglas Dynamics includes plumbers, towing companies, cable companies, and other companies willing to improve their trucks. Their revenue growth has increased from 300 million USD in 2014 to 561 million USD in 2019, which shows that the company has good performance and perspectives for the future. The dividend per share is 2%.

Financial information

Douglas Dynamics' stock price is considered to be undervalued by the Yahoo Finance fair price indicator. Currently, investors are trying to avoid risks. This is the main reason why the stock price is so low. However, if the economy rebounds, the price is likely to grow rapidly.

- Market capitalization: 817.384 million USD

- PE Ratio: 21.31

- EPS: 1.68

- Current Ratio: 2.42

Ford (Ticker: F)

It is not surprising to see Ford shares among cheap stocks. The company is experiencing some turmoil right now. However, they have enough dedication to move forward. Currently, the stock is not doing its best due to the current crisis. There is no doubt Ford will be able to come out of this. Once the economy recovers, the price of the stock is going to grow. Their revenue growth diagram is flat for the past several years. They have reached 160.24 billion USD revenue growth level and this is current ATH for the company.

Financial information

Ford stocks are considered to be undervalued by the Yahoo Finance indicator. This is fair but we should not forget about the crisis and about the fact that Ford is not the leader in this industry. However, the company has quickly recovered after 2008 crisis. It might do the same after the current crisis as well.

- Market capitalization: 24.777 billion USD

- PE Ratio: N/A

- EPS: -0.78

- Current Ratio: 1.32

Nikola Motors (Ticker: NKLA)

This is the newest electric car stock on Wall Street. The company was named after the famous scientist Nikola Tesla. NKLA has surged from 30 USD to 90 USD this year. What is the reason for this momentum? This company is a Tesla in the world of trucks. Nikola is the leading company in its industry and may become $ 100 billion worth company one day. They invest in the newest technologies, which is a good sign for future growth.

Financial information

Nikola stocks have surged significantly this year. In addition, we see even greater perspectives for this company. You can add this stock to your watch list, but it is better to see their revenue growth characteristics towards the end of 2020.

- Market capitalization: 23.784 billion USD

- PE Ratio: N/A

- EPS: N/A

- Current Ratio: 3.31

NIO (Ticker: NIO)

This is Tesla’s “brother” from China. The company’s main focus is electric cars. 2019 was not the best year for the company but everything has changed in 2020. The stock price surged and reached its all-time highs. However, the company's earnings are still below zero. Why do we think this stock is worth your attention? Since the electric car market is rebounding this year meaning the company is likely to boost its sales. This trend may continue for the next several years.

Financial information

NIO stocks are considered to be overvalued by the Yahoo Finance fair price indicator which is normal as the price is at its highs. However, we think that the company has a wider space to grow in the nearest future due to the recovery of the Chinese market. If the company manages to reach other markets, the stock may boom.

- Market capitalization: 8.467 billion USD

- PE Ratio: N/A

- EPS: -44.10

- Current Ratio: 0.53

Archimoto (Ticker: FUV)

Arcimoto company is based in Oregon. They specialize in manufacturing three-wheel electric cars. They believe that this three-wheel electric car industry looks very promising and will be in demand in the future. Their revenue has almost reached one million in 2019 but the earnings are still below 0. The situation may change when the delivery of commercial cars starts. They have great potential in this area.

Financial information

Arcimoto stocks are considered to be undervalued by the Yahoo Finance fair price indicator. The price is close to the highs. However, if the company reaches the commercial market in time, its stocks may have an even greater uptrend in the nearest future. The market for electric cars is growing fast.

- Market capitalization: 96.717 million USD

- PE Ratio: N/A

- EPS: -0.7780

- Current Ratio: 1.11

Is it a good idea to invest in the car industry during this crisis?

Some readers may think that it is not the right place and the right time to put their money into car stocks. And they have a reason to believe that. As of right now, no one can say for sure what is going to happen with the world economy and if it is going to recovers in the nearest future.

However, we firmly believe that cars are always in demand and electric cars attract particular attention. The goverments will stimulate sales anyway and those who have bought car stocks may be remunerated in the future by their price growth or by generous dividends.

Peter Smith

Peter Smith

Peter Smith

Peter Smith