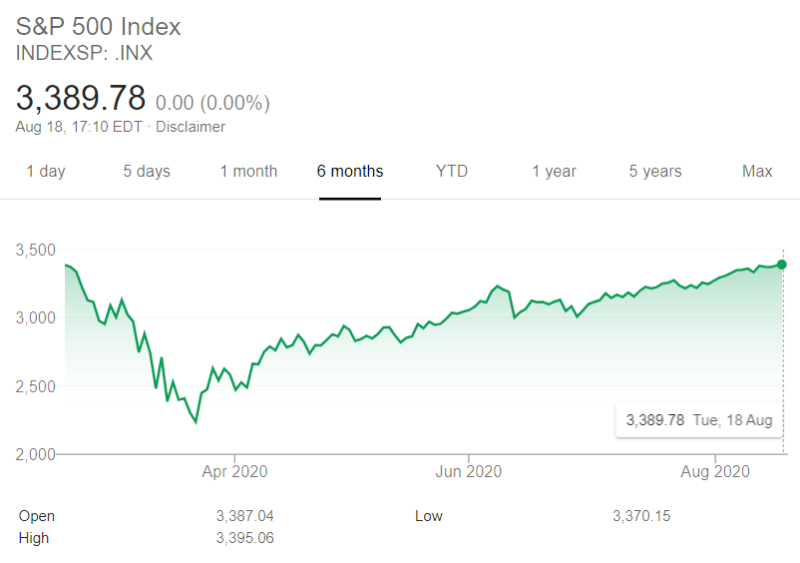

A significant landmark of this week was the most-watched test of the stability of the US financial market. The S&P500 index closed at 3,390, four points higher than its previous record set in February.

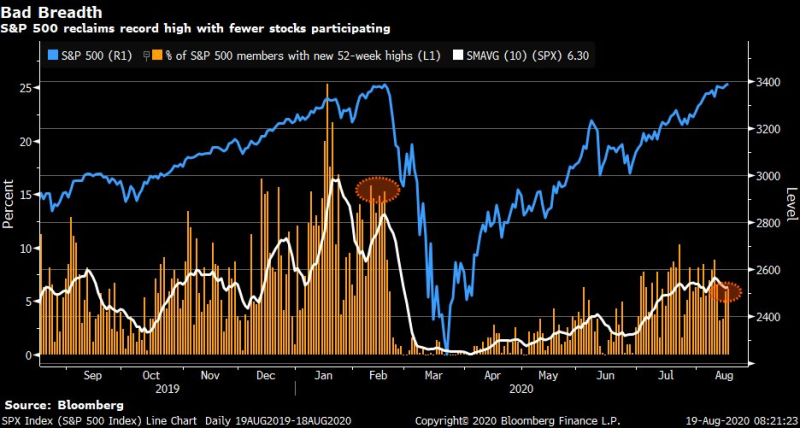

While the S&P500 has stabilized from the market's downturn at the end of March, this is only true on the general scale. About 60% of the shares in the index remain below its former level, and the average price is 7% below the high watermark.

Some claim that these securities have been doing extremely well since March, and we know for sure that this is the case. Technological capital, which is considered the biggest beneficiary of this pandemic, has risen way past its previous peaks.

S&P 500 back to all-time highs but % of members making a new 52w highs hovering around 6% … we’ve seen broader participation since market’s ascent from lows, but well below levels around February peak Liz Ann Sonders @LizAnnSonders via Twitter

The five biggest S&P500 inventories, all of which belong to the technology sector (Microsoft, Amazon, Apple, Alphabet and Facebook), account for a fifth of the overall growth from the start. The five businesses themselves account for a quarter of the index's worth.

Obviously, the rewards of a company over the next five years are greater (and easier to predict) than the gains it is to make in 20 years. Nonetheless, all of these future gains must be taken into consideration when settling up the correct option now.

This means that a short and dramatic decline in profits followed by a rapid recovery can barely impress the share's long-term value. When that is the view of the market, otherwise there may be an apparent gap between the current forecast and the estimation of the right share price by buyers in the short term.

Peter Smith

Peter Smith

Peter Smith

Peter Smith