When Chinese stocks reach record highs, investors recall the terrible fall of the market in 2015, but this time many of them are supported and encouraged by implicit government sponsorship for recovery and a strong economy.

The rise of the Chinese company's stock reminds Holger Zschaepitz of the reaction of the shares in 2015. Over the course of the past five months, China has taken the lead in the global rebound from the pandemic of coronavirus by about 23% and, this year, it is only second to the US Nasdaq index.

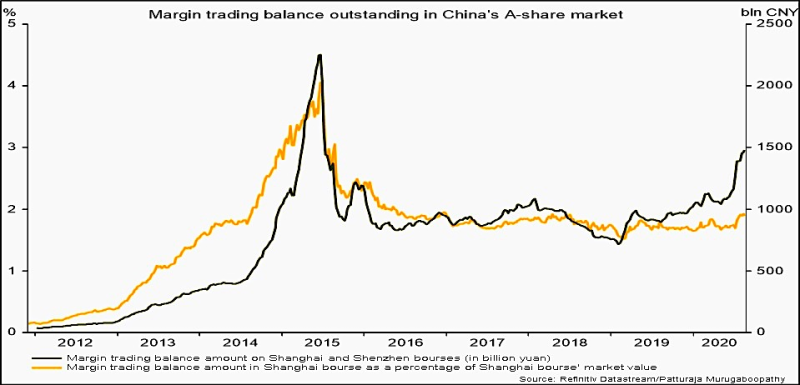

Raging Chinese stocks revive memories of 2015 crash. MSCI #China's price-to-book ratio at 2.06 surpassing 2015 high of 1.81. Margin financing, which allows investors to speculate on credit, had risen to 1.48tn Yuan, compared w/ peak of 2.6tn Yuan in 2015. Holger Zschaepitz @Schuldensuehner via Twitter

This upturn, nevertheless, pushed stocks up to the 2015 highs, from which inventory fell by 50% in a half of a year.

What Do the Charts Show?

MSCI China has a price-to-book ratio of 2.06 above a peak of 1.81 in 2015, an index where foreign investors follow in. The stock value of shares is measured in relation to the overall business financial reserves.

Nonetheless, Chinese stocks, when the economy recovers fairly quickly from the stalled pandemic recession and improved earnings for mainland companies, are well placed this time.

Exchange data show that premiums, which allow unit funds to distribute shares as leverage of creditors, rose to $214 billion and amounted to $1.48 trillion by the end of last week.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi