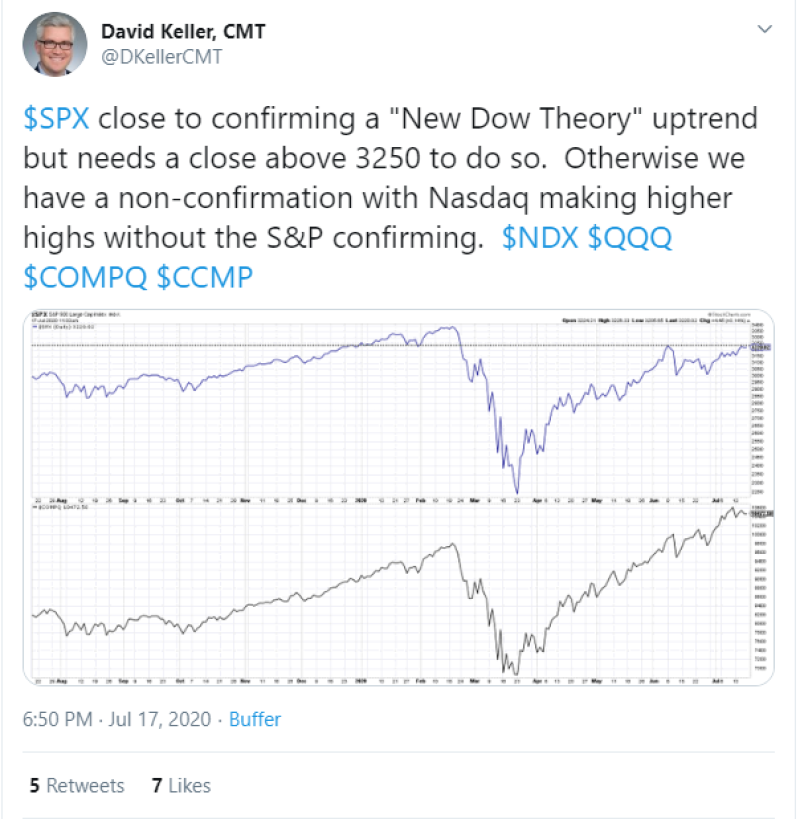

The S&P index is ready to break out its latest highs following the NASDAQ index, according to David Keller (@DKellerCMT). The analyst thinks that S&P 500 is able to establish new All-Time Highs (ATH) confirming the New Dow Theory.

To do that, the S&P 500 should close above 3,250. Otherwise, if the index fails to go over that level, the theory will not get confirmed and the NASDAQ 500 will move higher by itself.

Nasdaq Background

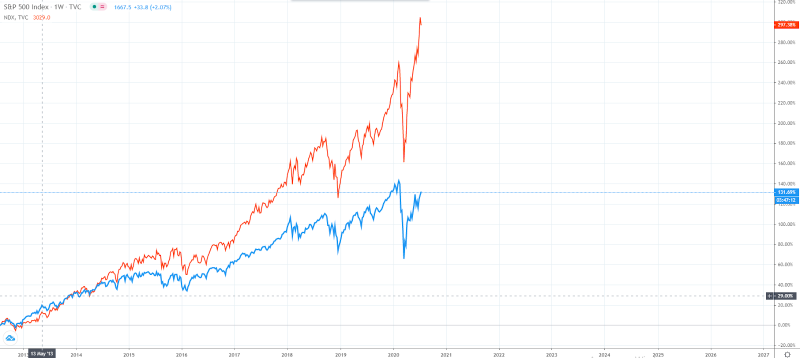

It is worth to mention that NASDAQ comprises technology companies and Internet-related businesses. Additionally, there are also financial, consumer, biotech, and some industrial firms in there. NASDAQ has reached its ATH in February 2020, but retreated from it later following the news on the global economic crisis and fears about its consequences.

Closer to the end of March, NASDAQ resumed its growth to break through the ATH in Summer. This is due to the fact that Internet-related companies suffer less from the current crisis, while biotech business is currently on the rise, because many of them are looking for a vaccine.

S&P500 Background

As for the S&P 500, this index includes 500 large-cap companies. Some of them are not performing well nowadays. The index has reached its top in February 2020 together with the NASDAQ and retreated from the ATH. The uptrend was resumed closer to the end of March. However, S&P500 is still unable to break through the latest ATH.

Latest economic news from the US as well as from the other part of the world demonstrate some recovery signs. This means that the S&P500 may have some additional support in breaking through its ATH. However, economists and politicians are very careful when doing their forecasts.

Peter Smith

Peter Smith

Peter Smith

Peter Smith