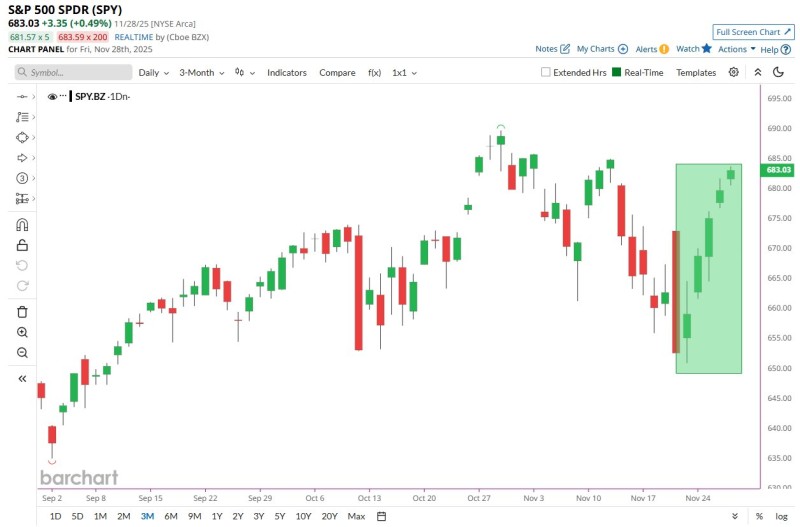

⬤ The S&P 500 just wrapped up something pretty unusual—five straight green days heading into Thanksgiving, the first time that's happened in nine years. SPY kept climbing throughout the shortened week, bouncing back nicely after some choppy action earlier in the month. The daily chart paints a clear picture: steady gains with green candles stacking up in what's become a textbook recovery zone.

⬤ Looking at the price action, SPY pushed up from mid-November lows around 650 and worked its way into the upper 680s without a single down day. That's a solid move after the sharp drops we saw earlier in the month. There weren't any major headlines driving this—it was just buyers stepping in consistently during what's historically been a friendly week for stocks.

⬤ This five-day winning streak helped SPY recover most of what it lost during that rough patch and get back on track with the broader uptrend we've seen all fall. The chart's showing exactly what traders like to see: a decisive bounce that's bringing SPY back into its comfort zone. When you get uninterrupted buying like this, especially after earlier volatility, it usually means confidence is coming back.

⬤ Why does this matter? Because SPY's rare clean sweep during Thanksgiving week could set the tone for what's coming. When the market strings together this kind of momentum during the holiday week, it often carries forward. That could mean a stronger setup heading into December and potentially more appetite for risk across U.S. stocks as we close out the year.

Peter Smith

Peter Smith

Peter Smith

Peter Smith