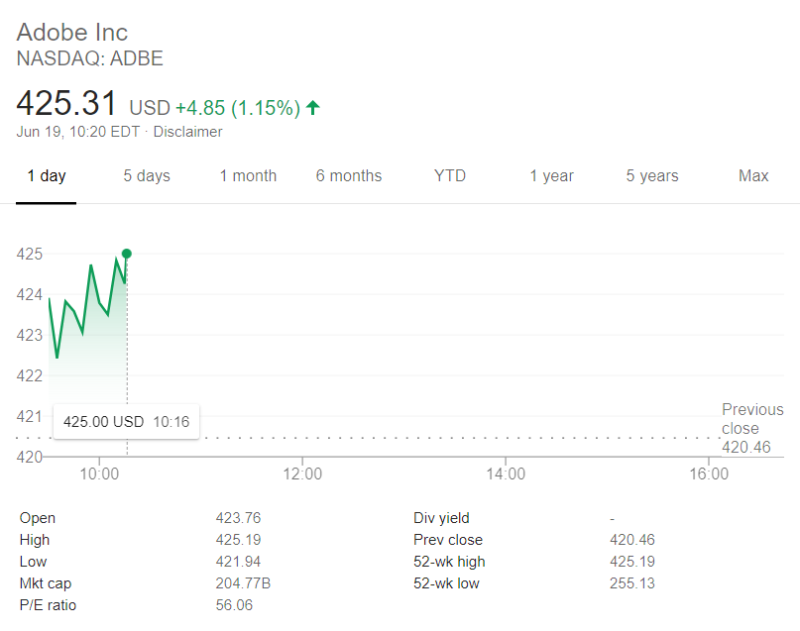

Adobe's stock price is again storming past historical highs. On Friday, the price per share broke the $420 mark and is not going to stop there. At the time of writing, the company's stock is trading at $425,31, which is +1.15% relative to Thursday's close.

On Wednesday, researchers from BidaskClub changed the rating of Adobe's stock from "Buy" to "Strong-buy" in their report.

On June 12, analysts at Morgan Stanley also raised their target price for Adobe shares from $375 to $450. They also gave the stock an “overweight" rating. Moreover, analysts at Barclays also set the target price at $450 and changed the "buy" rating in their June 10 report.

The company has a market capitalization of $199.22 billion, a P/E ratio of 55.47, a price-to-earnings ratio of 3.21. The company has a current ratio of 1.29, a fast ratio of 1.23, and a debt-to-equity ratio of 0.38.

Adobe presented its earnings report on June 11. The technology company reported earnings of $ 2.45 per share (EPS) for the quarter. This value exceeded Zacks' forecasts ($2.33) by $0.12.

Adobe's net profit was 30.72% and return on equity was 35.53%. Analysts' estimate of revenue was $3.16 billion, which was not quite close to the factual data of $3.13 billion.

Compared to the same quarter last year, Adobe's revenue increased by 14.1%. At the end of the fiscal year, equity research analysts expect Adobe to post 8.05 EPS.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov