FED's Market Support

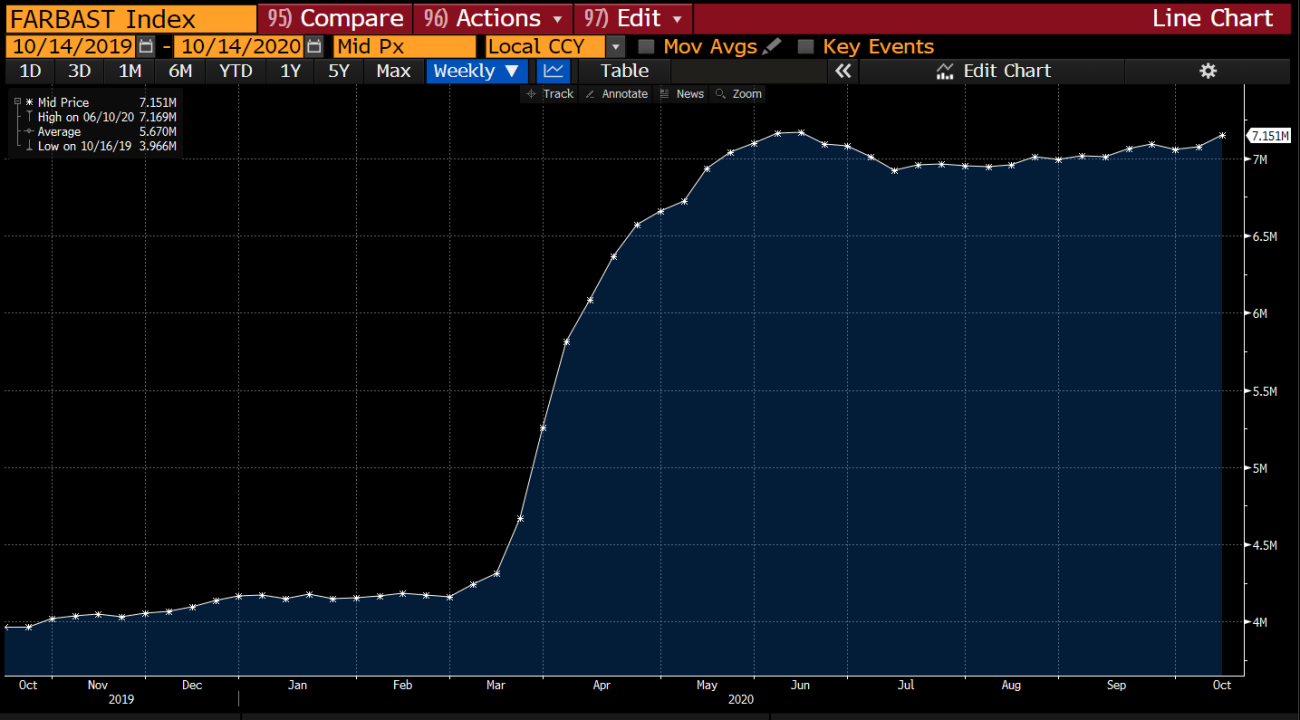

Since March, the Fed has raised the market to sustain money flows and ensure stability throughout the coronavirus pandemic. Even with unexpected growth of relief spendings, sales in approximately 80 billion treasuries a month have kept rates down and contributed to a flow of new debt on the market.

However, analysts are concerned about what might happen if the central bank slows down its purchasing rate. The Fed's funding could be necessary to prevent a full Treasury sector crash with the government expected to sustain high emissions for years.

FED's Holdings Record

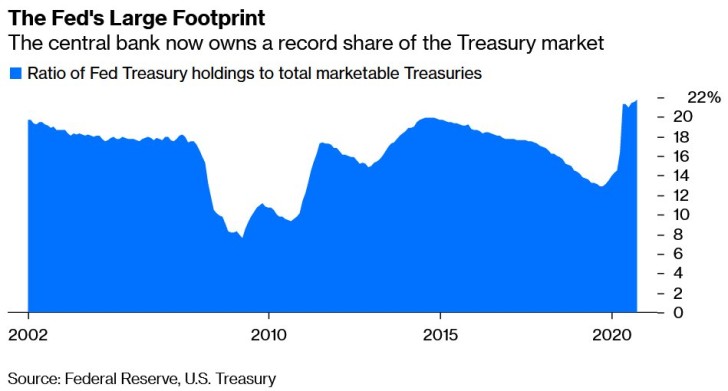

The CARES Act of $2.2 trillion and additional stimulus initiatives against the pandemic recession were launched throughout the entire year as public debt grew. Today it is over 26 billion dollars, up from 23 trillion dollars prior to the US being struck by COVID-19.

Consequently, the Fed now owns 22% of all market-traded Treasury securities, which is a new record. This is also 20% higher than in 2014.

Fed now owns 22% of all marketable Treasury securities, a new record & up from peak of 20% in 2014 ... in September 2019, share was just 13%, smallest since 2011 Liz Ann Sonders @LizAnnSonders

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi