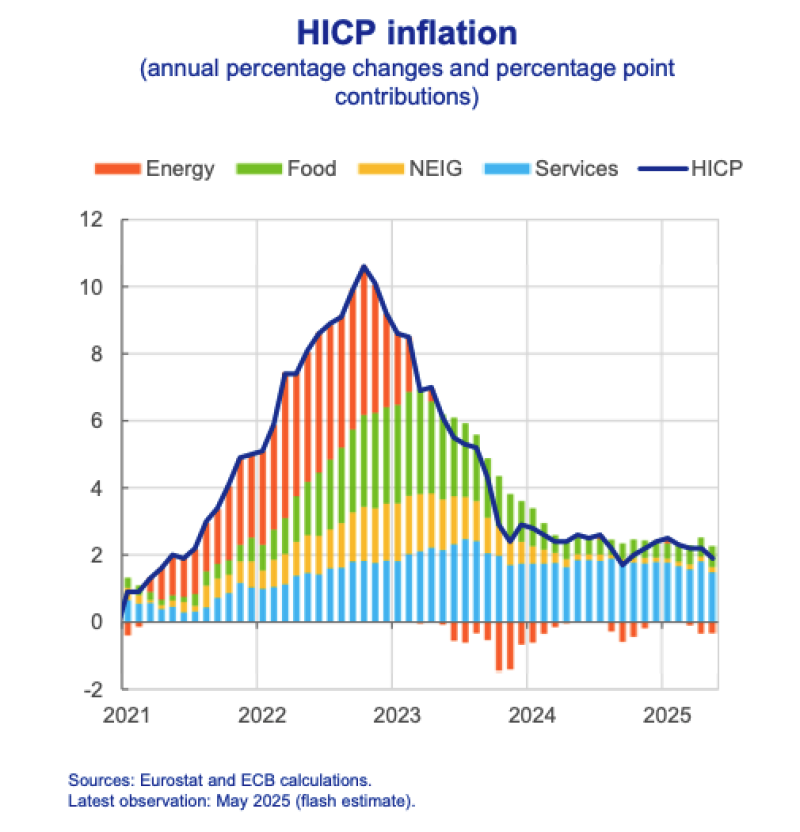

Eurozone inflation dropped to 2% in May 2025, hitting the ECB's target for the first time since 2021. But with energy prices falling and services staying stubborn, policymakers aren't celebrating just yet.

Inflation Finally Back Where ECB Wants It

Look, it's been a wild ride for European inflation, but we're finally seeing some good news. According to economist Philipp Heimberger's recent tweet, eurozone inflation hit exactly 2% in May 2025 - that's the ECB's sweet spot they've been trying to reach for years.

Remember how crazy things got? Back in October 2022, inflation was sitting at a nasty 10.6%. Energy prices were absolutely crushing everyone, adding over 4 percentage points to inflation all by themselves. People were freaking out about their heating bills and gas prices.

Energy's Doing Heavy Lifting, Services Still Being Stubborn

Here's where it gets interesting - energy has completely flipped the script. What used to be pushing inflation through the roof is now actually helping bring it down. Energy's contribution has gone negative, which basically means falling energy costs are making everything else look cheaper.

But services? Yeah, they're still being a pain. Services are contributing about 1.2 percentage points to inflation right now, making them the biggest troublemaker in the mix. Food and other industrial goods are adding maybe 0.4-0.5 percentage points combined, but services are really the stubborn one here.

What This Means for ECB Policy

So we hit the 2% target - mission accomplished, right? Well, not exactly. The ECB isn't popping champagne bottles just yet because this whole situation is pretty fragile. When your inflation target is only being met because energy prices crashed, and services are still running hot, you've got to stay careful.

The central bank knows that if energy prices bounce back or services inflation gets worse, we could be right back where we started. That's why they're probably going to keep their monetary policy pretty cautious for now, even though the headline number looks good.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah