The U.S. economy is showing signs of persistent inflation just as traders brace for the next Federal Open Market Committee meeting. The upcoming Consumer Price Index report, scheduled for October 24, is expected to reveal inflation at 3.1% year-over-year—higher than the previous month. This reading could shake up risk markets, including cryptocurrencies, as investors recalibrate their expectations heading into the final quarter of 2025.

Inflation Pressures Continue to Build

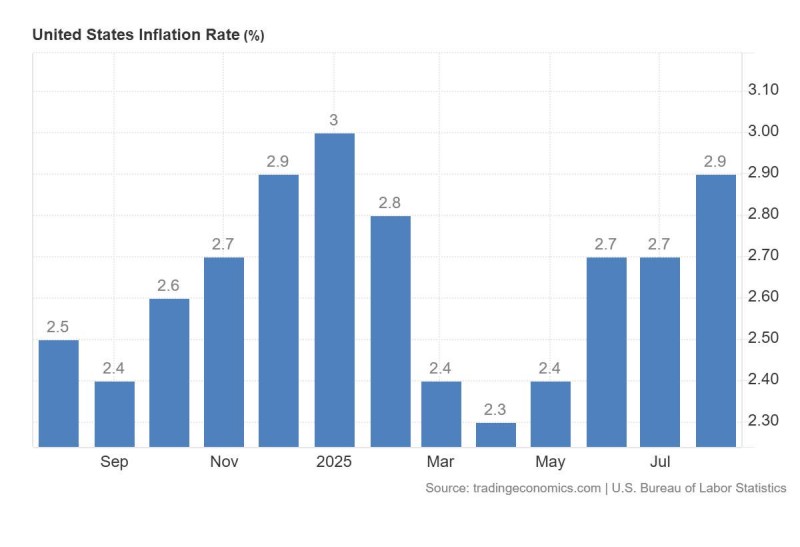

According to Cipher X and data from the U.S. Bureau of Labor Statistics, inflation in the United States has been creeping higher throughout 2025. After hitting a low of around 2.3% in April, the rate climbed back to 2.9% by July, showing that consumer prices remain stubbornly elevated.

This persistent upward trend suggests the Federal Reserve's earlier interest rate cuts haven't been enough to cool things down. Economists are now warning that the Fed might need to keep rates higher for longer—or at least hold off on further cuts—which isn't what markets were hoping for.

Mixed Signals Create Uncertainty for Bitcoin

The timing couldn't be more delicate. The CPI release lands just five days before the FOMC meeting, when traders are hypersensitive to any economic data. Making matters worse, the labor market report—usually a reliable indicator that's helped fuel Bitcoin's recent rally to $125,000—has been delayed because of the government shutdown. Without that data point, traders are flying a bit blind. Cipher X pointed out that even if the Fed does cut rates, markets might not respond positively, similar to what happened after September's cut. There's a growing sense that monetary policy alone won't be enough to keep risk appetite alive when inflation stays sticky and growth looks shaky.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir