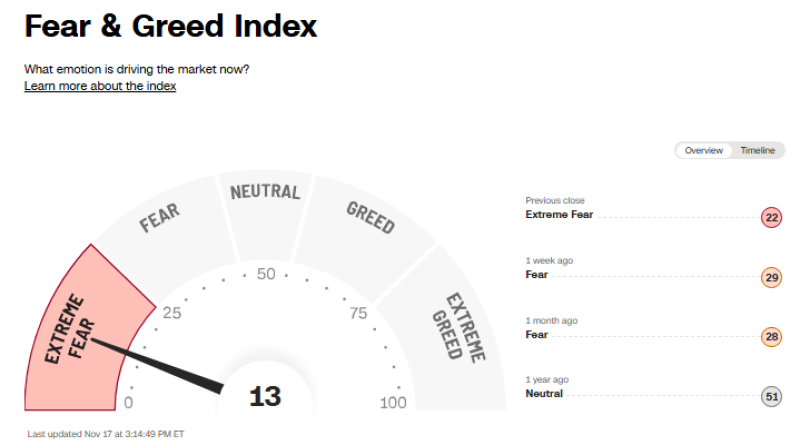

⬤ Market sentiment took a nosedive as the Fear & Greed Index dropped to just 13, pushing deep into Extreme Fear territory. This represents the worst reading in seven months, with the gauge—which runs from 0 to 100—now firmly planted in the red zone. The sharp decline shows just how quickly investor confidence has evaporated compared to where things stood even a few weeks back.

⬤ The numbers tell a pretty clear story. The previous session closed at 22, still in Extreme Fear mode but slightly better than today's reading. Rewind one week and the index sat at 29 (Fear), while a month ago it was at 28. Perhaps most striking is the year-over-year comparison: twelve months ago, the index was sitting comfortably at 51, right in neutral territory. That's a massive swing downward as volatility has ramped up and uncertainty has become the dominant theme across equity markets.

⬤ When the index hits these extreme lows, it's usually because several factors are lining up in the wrong direction: momentum is fading, volatility is spiking, investors are pulling back from risk, and money is flowing into safer assets. The current 13 reading is the most severe drop we've seen in seven months, suggesting traders have gotten increasingly nervous about what's coming next on the economic and financial front.

⬤ Why does this matter? Sentiment gauges like the Fear & Greed Index have real influence on how markets behave in the short term. When fear gets this intense, you tend to see wild swings in prices and rapid shifts in positioning as everyone tries to react to the same uncertainty at once. With sentiment now at one of its weakest points in months, the market is likely to stay jumpy and highly reactive to any new economic data, earnings reports, or policy announcements that come down the pipeline.

Peter Smith

Peter Smith

Peter Smith

Peter Smith