After weeks of sideways price action, XRP (Ripple) is capturing traders' attention again as liquidity concentrations intensify within a critical range. Recent on-chain data reveals a sharp increase in leverage activity between $3.6 and $3.8, suggesting the asset may be gearing up for its next significant move.

Analyst Spots Major Liquidity Buildup

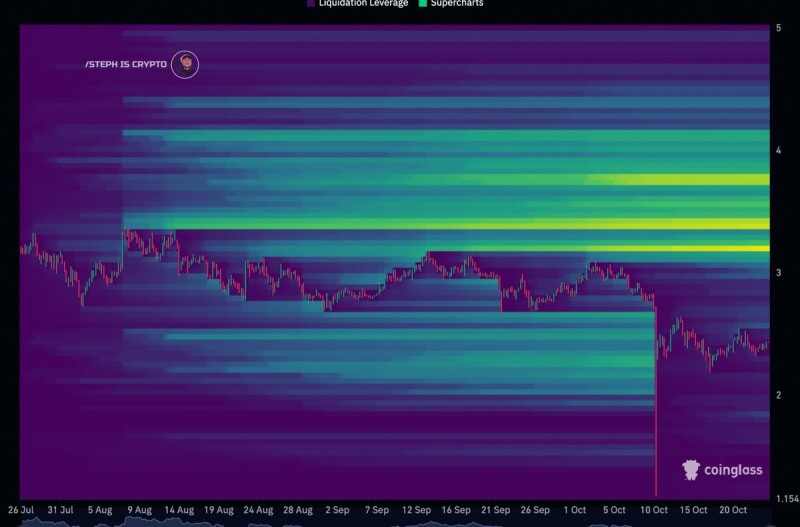

Market analyst STEPH IS CRYPTO recently pointed out a notable surge in XRP's liquidity cluster, describing it as "exploding in size" within the $3.6–$3.8 range.

The heatmap data from Coinglass shows this concentration through bright yellow-green zones, indicating areas where leveraged positions and potential liquidations are densely packed. This type of buildup typically appears before major price movements, as accumulated open interest creates magnetic zones that attract price action.

Liquidity Hunt Could Drive Price Higher

When leverage concentrates around a narrow band like this, the market often experiences what traders call a "liquidity hunt"—a move designed to trigger these clustered positions before establishing a new direction. For XRP, this pattern suggests a likely test of higher levels as the market absorbs pending orders. Meanwhile, the chart shows relatively thin liquidity below $2.0, meaning downside risk appears limited for now. This imbalance reinforces the probability of an upward push as participants target the dense concentration above current prices.

What's Next for XRP

If momentum builds and XRP breaks through the $3.8 resistance zone, the next liquidity target could emerge around $4.2–$4.5. The current setup indicates XRP is entering a phase of market compression where leverage, positioning, and liquidity converge to create conditions for a decisive move. Traders are now watching closely to see whether the next impulse confirms the buildup or triggers a rapid sentiment shift across the broader altcoin market.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi