Stellar (XLM) has been quietly building momentum after weeks of sideways action. The token is once again knocking on the door of $0.50 resistance - a critical level that's turned back several attempts in recent months. If buyers finally punch through this ceiling, we could see a meaningful surge unfold. This $0.50 mark represents a pivotal moment that could either ignite a rally toward the coveted $1 level or send the price back to lower support zones.

Technical Setup: Triangle Tightens

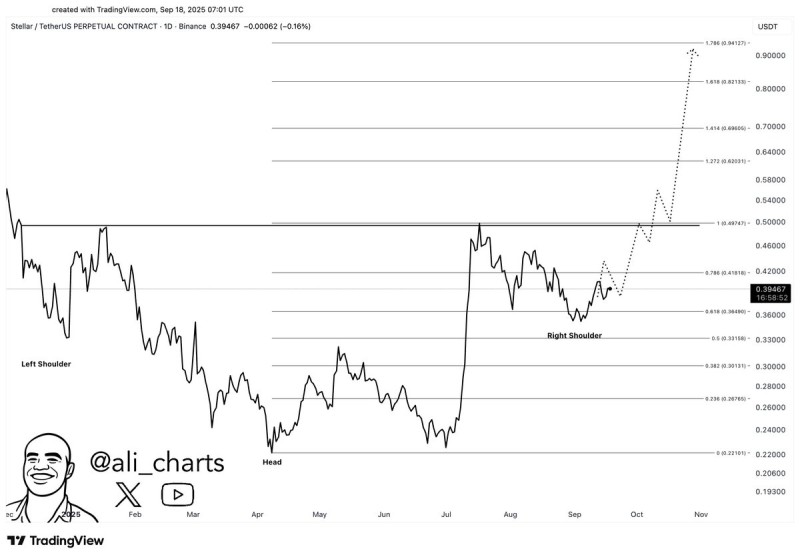

XLM is painting a textbook ascending triangle on the charts. Buyers have been stepping in at progressively higher lows while sellers continue to defend that stubborn $0.50 resistance. As noted by analyst Ali, this level has become the ultimate battleground for bulls and bears.

The immediate resistance sits firmly at $0.50, while support has established itself around $0.45-$0.46, with a deeper safety net at $0.41-$0.43. This type of triangular compression typically resolves upward as buyer pressure intensifies against a fixed resistance level. The tightening price action suggests we're approaching a resolution point where something's got to give.

Breakout Targets: Mapping the Rally

Should XLM finally crack $0.50 with conviction, the first logical target zone sits between $0.60-$0.68. This projection comes from measuring the triangle's height and previous supply areas that could act as temporary roadblocks. Beyond that, the $0.75-$0.80 region aligns with historical resistance levels that marked previous cycle peaks.

The ultimate prize remains the psychological $1.00 level - a major supply zone from earlier cycles that would represent a significant milestone for Stellar holders. However, traders should remain cautious of false breakouts. If XLM can't maintain its footing above $0.50 after an initial break, we'd likely see a retreat back toward the $0.43-$0.45 support cluster.

Why This Time Could Be Different

Several factors are aligning to support a potential breakout. The broader crypto market has been rotating capital into altcoins when Bitcoin enters consolidation phases, and XLM's clean technical setup makes it an attractive candidate for such flows. The macro environment also appears supportive, with central bank policies potentially providing the liquidity backdrop that risk assets need to thrive.

From a fundamental perspective, Stellar's ecosystem continues to evolve with developments like Soroban smart contracts and expanding cross-border payment partnerships. These improvements provide a solid foundation beneath the technical setup, giving investors more reasons to believe in the project's long-term trajectory.

Make or Break Time

XLM stands at a crossroads where $0.50 will either become a launching pad or another false dawn. A convincing breakout with strong volume would validate the bullish triangle pattern and put $0.60-$0.68 squarely in focus, with $1 becoming a realistic target if momentum sustains. Until that breakout materializes, the key will be watching whether buyers can defend the $0.45 support level while the market waits for this coiled spring to finally release its energy.

Peter Smith

Peter Smith

Peter Smith

Peter Smith