Solana (SOL) saw a significant price increase following VanEck's announcement of filing an ETF application with the SEC, highlighting the blockchain's growing market confidence.

VanEck's ETF Filing Boosts Solana by 8.7%

Solana, renowned for its speed and scalability, experienced a notable price surge as digital asset manager VanEck announced filing an application with the U.S. Securities and Exchange Commission (SEC) to launch an ETF based on Solana (SOL). This development immediately led to an 8.7% increase in SOL's value within a single day.

Yesterday, VanEck, a key player in digital asset management, submitted its ETF application to the SEC, aiming to establish a fund based on Solana. This filing had an immediate and positive impact on Solana’s market value, which recorded an 8.1% increase. The surge was significant, especially considering that other cryptocurrencies were experiencing stagnation or slower growth rates.

Solana Market Performance Post-Announcement

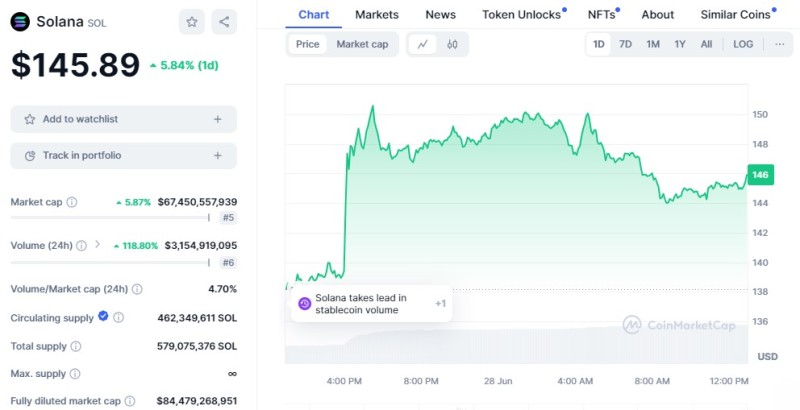

Solana’s trading price now fluctuates between $145 and $146 per coin, pushing its market capitalization to approximately $69 billion. While this performance remains below the all-time high of $259 achieved in November 2021, the recent uptick reflects renewed investor confidence and suggests a potential new growth phase for Solana.

The enthusiasm surrounding VanEck's announcement is partly due to the growing recognition of Solana as a valuable asset within the crypto ecosystem. VanEck’s choice to base an ETF on Solana enhances the blockchain's credibility and appeal. This positive sentiment could lead to increased institutional interest and adoption of Solana in financial markets.

Potential Shift in Crypto ETFs with Solana

VanEck’s initiative might signal a transformative shift in cryptocurrency investments. By categorizing Solana as a commodity rather than a security, VanEck opens new avenues for integrating cryptos into traditional financial markets. This innovative perspective could inspire other financial entities to follow suit, creating a beneficial ripple effect across the crypto landscape.

The timing of VanEck’s decision is crucial as the SEC is also reviewing other ETF applications related to Ethereum. Successful approval of these initiatives could significantly enhance the legitimacy of cryptocurrencies as viable financial assets, attracting a new wave of institutional investments.

Conclusion

VanEck’s move to establish a Solana-based ETF represents more than just a market event; it symbolizes a potential evolution in integrating cryptocurrencies into traditional financial systems. The future of this initiative will depend on regulatory responses and the market's adaptability to these emerging opportunities.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah