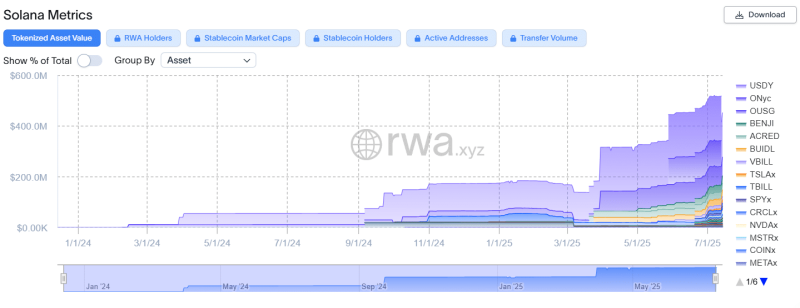

Solana's tokenized assets just reached $550 million in volume, making SOL the third-biggest RWA blockchain. This rapid growth could boost SOL price as it starts competing with Ethereum.

The tokenized asset world is heating up big time. We're now looking at $25.50 billion locked in real-world assets (RWAs) on-chain – that's up 6% in just the past month. Nearly $10 billion of that came in 2025 alone, so yeah, this sector's definitely picking up steam.

For those wondering what RWAs are – think traditional stuff like U.S. Treasuries, real estate, and private credit, but turned into crypto tokens. It's basically where old-school finance meets blockchain yields.

Solana (SOL) has been making some serious moves here. Right now, the network's got 79 tokenized assets live, with total RWA value hitting $550 million. That puts SOL in third place by volume, which isn't bad at all.

But let's be real – Ethereum's still way ahead with $7.77 billion in RWA value and over 80,000 holders. That's some serious dominance, built on years of mature infrastructure that made ETH the go-to choice for tokenizing assets.

SOL's Speed Advantage Is Starting to Show

Here's where things get interesting. Solana's actually processing 1,023 real transactions per second based on actual on-chain activity. Most chains barely hit 100 TPS in real-world use, and Ethereum? It's stuck at just 16 TPS. That's a massive bottleneck for a network that's supposed to be the backbone of DeFi.

The numbers don't lie either. SOL's tokenized asset holders jumped 684% in the past 30 days, hitting 58,123 people. Meanwhile, Ethereum's holder count only grew by 4.96% in the same period. That's a pretty sharp difference.

Can SOL Actually Challenge Ethereum's RWA Lead?

Solana was built to be an "Ethereum killer" five years ago, and in some ways, it's delivered on that promise – especially when it comes to speed and costs. The question now is whether SOL can turn these technical wins into real market share.

With developers starting to tap into Solana's advantages for RWA projects, the network's tokenized assets are looking more and more like a credible threat to Ethereum's dominance. SOL's faster execution and lower costs give it clear technical edges that could attract more projects and users.

The holder growth tells the story – while Ethereum's growth has slowed to under 5%, Solana's exploding at 684%. That kind of momentum in the RWA space could be a real catalyst for SOL's price, especially as more utility typically means better token performance.

The next few months will show if SOL can keep this growth going and actually start eating into Ethereum's market share. With $25+ billion flowing into tokenized assets, there's definitely room for multiple winners – and Solana's looking like it wants a bigger piece of that pie.

Usman Salis

Usman Salis

Usman Salis

Usman Salis