Silver (XAG/USD) slipped to $33.08 per troy ounce on Tuesday, dropping 1.15% from Monday's close, though it's still up a solid 14.50% for the year.

Silver (XAG/USD) had a rough day on Tuesday, sliding down to $33.08 per troy ounce as sellers stepped in across precious metals markets. The shiny metal gave back some ground from Monday's $33.47 close, chalking up a 1.15% loss according to fresh data from FXStreet.

Silver (XAG) Still Shining Bright Despite Tuesday's Stumble

Here's the thing though - even with Tuesday's pullback, silver (XAG) is still having a pretty decent year. We're talking about a hefty 14.50% gain since January, which isn't too shabby at all. This kind of performance shows there's still plenty of juice left in the precious metals story, even when we get these occasional speed bumps.

Right now, silver's sitting at what many traders are calling a make-or-break level around that $33 handle. Everyone's watching to see if this dip is just a quick breather or something more serious brewing under the hood.

Breaking Down Silver (XAG) Prices: What You Need to Know

So let's talk numbers - silver (XAG) is currently trading at $33.08 per troy ounce, which works out to about $1.06 per gram. That might not sound like much of a difference, but it actually matters quite a bit depending on how you like to buy your silver.

If you're a big player - think hedge funds or institutions - you're probably dealing in troy ounces. But if you're just a regular person looking to add some silver to your portfolio, those gram prices might be more your speed. It's pretty cool how the same metal can appeal to such different types of investors.

What's Next for Silver (XAG)? The Technical Picture

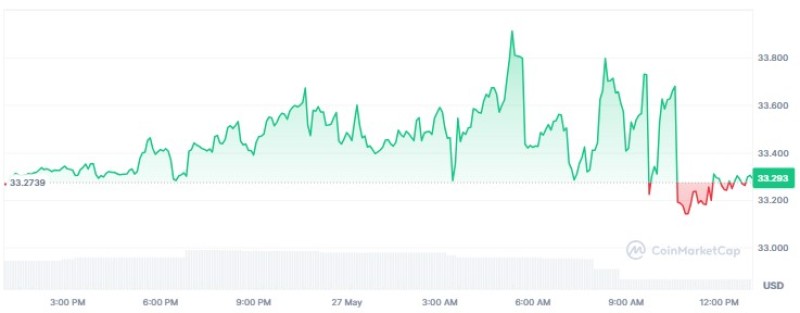

From where I'm sitting, silver's (XAG) drop from $33.47 to $33.08 looks like it's testing some important support levels. The 1.15% decline isn't exactly panic-selling territory, but it's enough to get people's attention.

Chart watchers are keeping their eyes glued to that $33.00 level - if silver can hold above there, we might just see this as a quick pit stop before the next leg higher. But if it breaks below, then $32.50 becomes the next line in the sand. On the upside, getting back above $33.47 would be a good sign that the bulls are still in control.

The Bottom Line for Silver (XAG) Traders

Look, if you're trading silver (XAG) right now, you're dealing with a pretty interesting setup. On one hand, you've got this solid 14.50% gain for the year that shows there's real demand out there. On the other hand, you're getting these daily swings that can either make your day or ruin your morning coffee.

The key things to watch going forward? Keep an eye on what the Fed's up to with interest rates, how the economy's holding up, and whether industrial demand stays strong. Oh, and don't forget to check how silver's doing compared to gold and other commodities - sometimes the best trades come from those relative moves rather than trying to call the absolute direction.

Bottom line: silver (XAG) is still in a pretty good spot despite Tuesday's stumble, but as always, make sure you're not betting more than you can afford to lose.

Peter Smith

Peter Smith

Peter Smith

Peter Smith