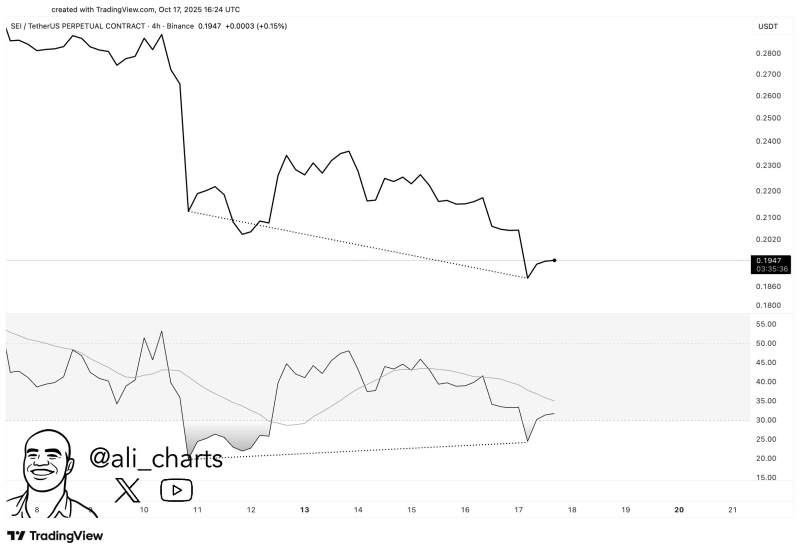

● Analyst Ali recently pointed out that SEI is showing a bullish divergence on the Relative Strength Index (RSI)—a technical pattern that often hints at a possible price reversal. While SEI's price has been trending down, the RSI has started climbing, suggesting that selling pressure may be losing steam.

● This divergence offers traders a potential entry point, but it's not without risk. Bullish divergences can lead to upward reversals, yet in crypto's unpredictable environment, they can also fail. If SEI drops below the $0.19 support level, it could trigger more selling and shake market confidence.

● If the signal plays out, SEI could see a rebound that brings back speculative interest and short-term trading volume. But if the price breaks down despite the divergence, traders banking on this setup might take losses, pushing them toward safer bets.

● This SEI setup is being watched as a bellwether for mid-cap altcoins. A successful bounce could boost market participation and trading activity. A failure, however, might dampen retail and institutional interest, slowing down both trading flows and related economic activity in the sector.

● As SEI hovers near this key level, all eyes are on whether the divergence turns into a real rally or fizzles under continued selling.

Usman Salis

Usman Salis

Usman Salis

Usman Salis