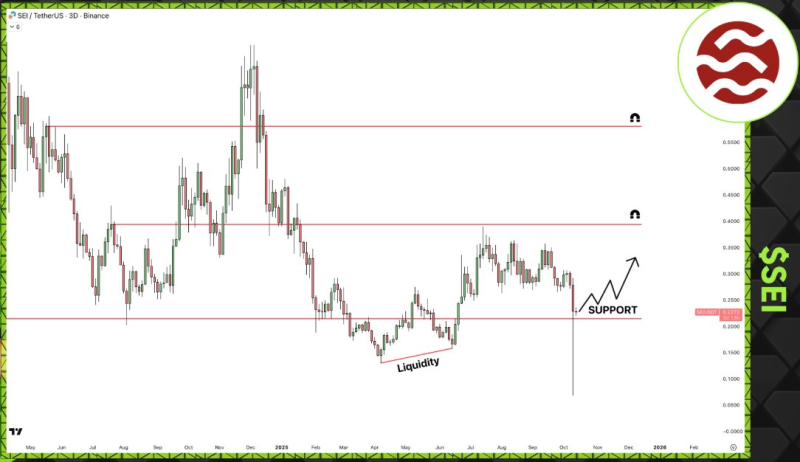

SEI recently experienced a sharp price move that briefly pushed it below key support before quickly bouncing back. This type of liquidity grab often marks a turning point in the market. The swift recovery suggests buyers remain active at lower levels, and the coin now faces crucial resistance zones that could determine its next direction.

The Liquidity Sweep

Trader Sei Intern (Unofficial) pointed out the aggressive move that briefly took SEI under the $0.20 mark before prices snapped back. This kind of action typically clears out weak hands and tests where real demand sits. The quick rebound shows that buyers stepped in to defend the $0.20 zone, which now acts as an important support level.

Key Levels to Watch

Support and resistance zones from the 3-day chart:

- Current price sits around $0.23 after the bounce

- Support zone at $0.20 held firm during the wick

- First resistance near $0.32, followed by $0.45

- Longer-term upside target around $0.58

The chart pattern resembles what often happens before accumulation phases, where prices consolidate before moving higher.

Why This Matters

SEI has built a reputation as a blockchain optimized for trading and DeFi applications. The recent liquidity sweep indicates that larger players are actively testing the market, which usually happens before a new trend emerges. This resilience keeps SEI on the radar for those watching for potential breakouts.

What Comes Next

If SEI holds above $0.20 and breaks through $0.32, it could target the $0.45 zone. However, a drop back below $0.20 would likely signal more downside ahead. Volume will be the tell - increasing buying pressure would confirm that the market is gearing up for an upward move.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah