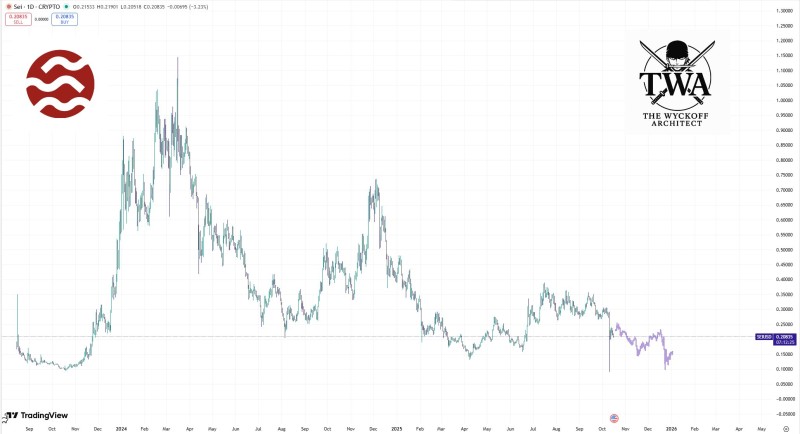

SEI finds itself at a critical juncture as prolonged selling pressure pushes the token toward a potential cyclical bottom. Trading near $0.20, the asset shows clear signs of exhaustion in its distribution phase.

Technical Overview

Market analyst The Wyckoff Architect recently noted that SEI is working through its final downward wave, which typically requires time to fully develop rather than completing in a single sharp move.

The daily chart reveals a long-term distribution structure characterized by declining highs and persistent weakness. SEI is progressing through what appears to be its last downward wave, with analysts eyeing December as the potential completion point. The $0.18–$0.20 zone represents a critical support area that could mark the bottom of this cycle. Declining volume suggests seller exhaustion, though buyers haven't shown strong conviction yet, indicating the token may continue grinding lower before finding stability.

SEI's bearish trend reflects several headwinds. Bitcoin's dominance has pulled liquidity away from smaller altcoins, while the Wyckoff distribution pattern indicates institutional players likely exited positions earlier, leaving retail to absorb ongoing sell-offs. The absence of major ecosystem developments has further dampened interest, pushing momentum traders toward more active opportunities.

Outlook

If the current thesis proves correct, SEI should complete its distribution cycle by year-end, potentially transitioning into an accumulation phase. This would mean stabilization around current support levels before fresh demand emerges. A move above $0.25–$0.30 would signal the first signs of trend reversal, while breaking below support could expose the token to deeper lows not seen since its initial listings.

SEI remains trapped in the final stages of an extended distribution phase, with bearish pressure still dominating the near-term picture. As emphasized by market observers, completing this wave structure takes time, meaning patience will be essential for traders seeking entry points. By December, the market should have clearer answers about whether SEI has hit its cyclical bottom or if further downside awaits before any meaningful recovery begins.

Usman Salis

Usman Salis

Usman Salis

Usman Salis