The cryptocurrency market continues to present compelling technical opportunities, and SEI has emerged as a token worth watching. Following a successful retest of its breakout zone, technical analysts are pointing to favorable conditions that could drive the price significantly higher. This analysis examines the current setup and explores why $0.37 represents a crucial target for traders and investors alike.

SEI Price Retest Confirms Breakout

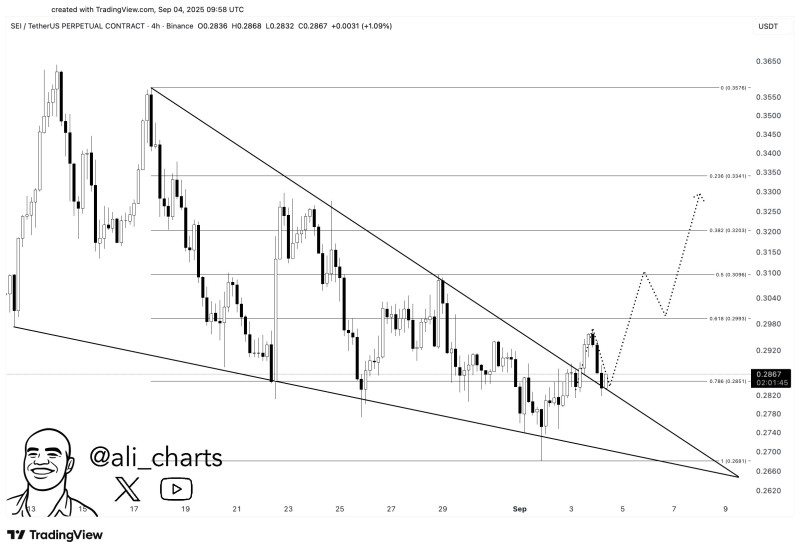

SEI's chart reveals strong technical momentum after the price successfully retested its breakout zone near $0.28–$0.29. This support validation typically signals renewed buying interest and sets up favorable conditions for upward movement. Traders are now monitoring key resistance levels for potential entry points.

Trader Sees Bullish Path to $0.37

Market analyst @ali_charts has identified what appears to be a well-structured bullish setup for SEI. According to their technical analysis, the path higher looks promising, with intermediate targets at $0.31 and $0.33 before reaching the primary objective of $0.37.

What makes this analysis particularly compelling is how these target levels align with established technical indicators. The projected price points correspond with Fibonacci retracement zones, which are widely respected by technical traders as areas where price often encounters either support or resistance. This confluence of technical factors strengthens the case for the bullish scenario.

What Makes $0.37 a Key Level for SEI

The $0.37 target represents both a technical extension and psychological resistance level. Breaking above this price could trigger additional buying momentum and attract new market participants. For this bullish scenario to play out, SEI needs to maintain support above the $0.28–$0.29 range on higher timeframes.

Peter Smith

Peter Smith

Peter Smith

Peter Smith