- The API Revolution in Financial Infrastructure

- Modular Architecture: The Building Blocks

- Accelerating Time-To-Market for Crypto Functionality

- Lowering Technical Barriers for Nonspecialists

- Market Adoption and Growth Trajectory

- Implementation Strategies for Success

- The Future of Crypto Infrastructure Access

Neil Bergquist, co-founder and CEO of Coinme, has championed an API-first approach designed to lower these barriers and make crypto infrastructure accessible to businesses of all sizes.

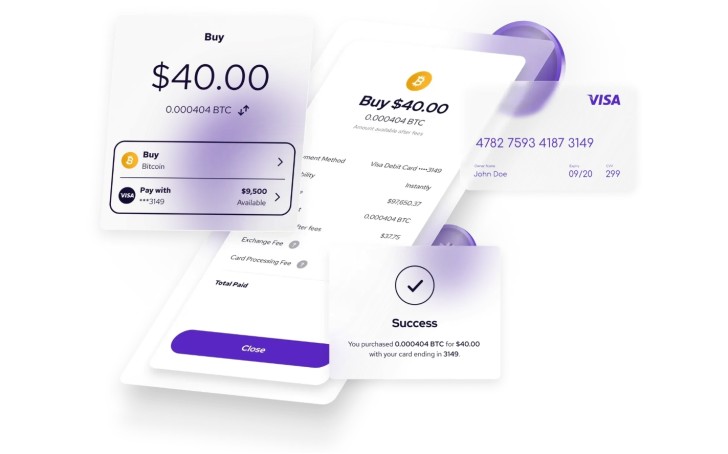

"We're a platform that provides crypto infrastructure," Bergquist explains. "That infrastructure is the ability to create an account and conduct KYC, known as know-your-customer. This enables Coinme and our partners to be compliant with various state and federal regulations, and allow customers to use a debit card or cash to buy or sell digital currencies."

The API Revolution in Financial Infrastructure

APIs have fundamentally transformed how businesses access sophisticated technologies. Rather than building complex systems from scratch, organizations can now leverage prebuilt functionalities through standardized interfaces, accelerating deployment while reducing technical overhead.

In the cryptocurrency sector, this shift holds particular significance. Blockchain integration traditionally required specialized expertise in cryptography, distributed systems, and secure key management — resources that may be beyond the reach of many organizations. By abstracting these complexities behind well-documented APIs, Coinme enables businesses to incorporate crypto capabilities without becoming blockchain experts themselves.

"We handle that complexity for you," Bergquist notes. "You don't need to download a wallet, you don't need to worry about digging up a landfill because you lost your USB stick in order to access your bitcoin." These capabilities democratize access to cryptocurrency infrastructure, allowing businesses to focus on their core competencies while still offering innovative digital asset solutions.

Modular Architecture: The Building Blocks

Coinme's platform architecture follows a modular design philosophy, providing discrete functional components that businesses can selectively implement. This contrasts with monolithic solutions that force organizations to adopt comprehensive systems regardless of their specific needs.

"Because Coinme has these baskets of infrastructure, we're able to allow the partner or the token project to really pick and choose the user experience that they want to provide," Bergquist explains. "Some just want to distribute the token as a reward and then allow people to sell it and redeem it for cash. So they might just use custody and APIs from Coinme. Or maybe they want people to be able to buy it, or they want people to be able to swap it.".

The platform's core modules include:

- Account creation and KYC verification: Providing regulatory-compliant onboarding for users.

- Payment processing: Enabling fiat currency transactions for purchasing digital assets.

- Cryptocurrency custody: Securely managing digital assets on behalf of users.

- Token redemption: Facilitating conversion from crypto back to traditional currencies.

- Blockchain interaction: Managing transactions across various cryptocurrency networks.

Each component addresses specific technical challenges that would otherwise require substantial development resources. By providing these capabilities through standardized interfaces, Coinme significantly reduces implementation complexity while ensuring enterprise-grade security and compliance.

Accelerating Time-To-Market for Crypto Functionality

For businesses exploring cryptocurrency integration, time-to-market considerations often prove decisive. Building blockchain capabilities internally typically requires months of development, testing, and regulatory consultation — a timeline incompatible with competitive market dynamics.

API-driven tactics dramatically compress these timelines. "If you have a token and you want someone to be able to buy it, you're going to need to offer a fiat payment processing to be able to purchase that token, and that's where Coinme comes in," Bergquist notes. "We're able to provide those payment rails where someone can actually be on a website or in an app and be able to actually purchase a token."

By providing ready-made solutions for these technical challenges, Coinme enables businesses to launch crypto-enabled features in weeks rather than months or years. This acceleration represents a significant competitive advantage, particularly in rapidly evolving markets where first-mover benefits can prove substantial.

Lowering Technical Barriers for Nonspecialists

Neil Bergquist emphasizes that Coinme's platform specifically addresses the needs of organizations without specialized blockchain expertise. While technology giants and financial institutions often possess the resources to build custom crypto solutions, most businesses lack these capabilities.

"We see ourselves as just having all the ingredients to let the partner make whatever amazing dish they want to create for their customer," he explains.

This proves particularly valuable for traditional financial institutions exploring cryptocurrency services without disrupting existing operations; retailers seeking to implement tokenized loyalty programs or accept crypto payments; app developers building financial services that incorporate digital assets, and small businesses wishing to participate in the crypto economy without substantial technical investment.

For these organizations, API-based solutions transform cryptocurrency integration from a specialized technical project to a straightforward business decision. Rather than assembling blockchain development teams, they can focus on designing compelling customer experiences while leveraging Coinme's infrastructure for technical execution.

Market Adoption and Growth Trajectory

The market for cryptocurrency infrastructure continues to expand rapidly. The global blockchain-as-a-service market is projected to reach $84.6 billion by 2031, growing at a compound annual rate of 59.3%. This growth reflects increasing demand for accessible blockchain solutions across various industries.

Bergquist observes that demographic shifts further accelerate this trend. Recent research indicates that 28% of investors aged 21 to 43 see greater growth potential in crypto and digital assets, compared to just 4% of those 44 and older. As younger consumers gain purchasing power, their preference for crypto-enabled services will likely drive further adoption among businesses serving these demographics.

The API-driven model appears particularly well-positioned to capture this growth. According to industry projections, international B2B blockchain transactions could top $1.7 billion by 2025, with much of this activity flowing through standardized interfaces rather than custom implementations.

Implementation Strategies for Success

For organizations exploring cryptocurrency integration through API-based approaches, Bergquist recommends several strategic principles:

1. Start With Specific Use Cases

Rather than attempting comprehensive cryptocurrency implementation, businesses should identify targeted use cases that address concrete business needs. Examples include tokenized loyalty programs, cross-border payments, or digital asset custody for specific customer segments.

2. Prioritize User Experience

API-based methods offer significant flexibility in designing customer experiences. Organizations should focus on creating intuitive interfaces that abstract blockchain complexities while highlighting the unique benefits of cryptocurrency functionality.

3. Build on Regulatory Foundations

Compliance considerations should inform implementation from the earliest planning stages. Bergquist has consistently emphasized Coinme's commitment to regulatory compliance: "From day one, we've worked with regulators to ensure our business complies with state and federal regulations."

By leveraging platforms with established regulatory frameworks, businesses can mitigate compliance risks while accelerating time-to-market.

The Future of Crypto Infrastructure Access

Neil Bergquist anticipates further democratization of cryptocurrency infrastructure through increasingly sophisticated API-based solutions. As the technology matures, implementation will likely become even more accessible to organizations regardless of their technical sophistication.

This trend aligns with broader patterns in technology adoption, where complex capabilities increasingly become available through standardized interfaces. Just as cloud computing transformed access to computing resources, API-driven approaches are reshaping how businesses engage with blockchain technology.

For forward-thinking organizations, these developments create significant opportunities to incorporate digital asset capabilities without substantial technical overhead. By leveraging platforms like Coinme's, businesses of all sizes can participate in the cryptocurrency economy while focusing on their core competencies and unique value propositions.

Editorial staff

Editorial staff

Editorial staff

Editorial staff