Recent on-chain data reveals a notable shift in Ethereum's market dynamics. Mega whales—addresses holding over 10,000 ETH—have started selling after a prolonged accumulation period. This change could signal early caution among large holders as Ethereum's price faces resistance near the $3,400 mark.

Chart Analysis: Whales Begin to Exit Positions

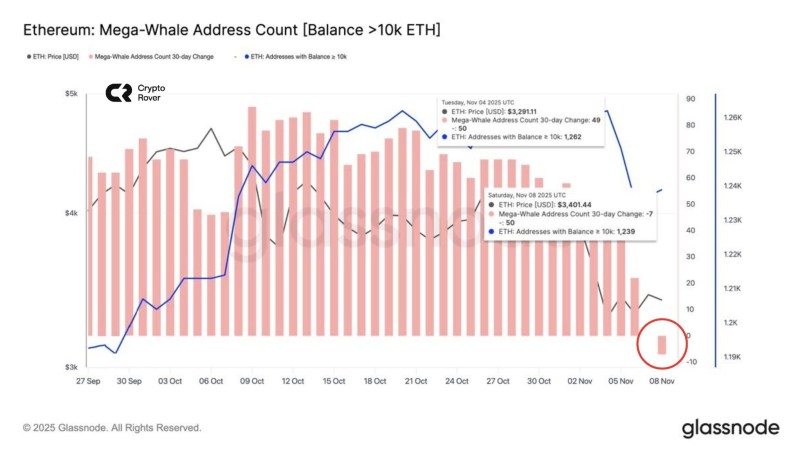

Data from Glassnode tracks three key metrics: Ethereum's price movement, the number of addresses holding more than 10,000 ETH, and the 30-day net change in these whale addresses.

Between late September and early November, Ethereum's price climbed from roughly $3,000 to $3,400, backed by steady whale accumulation. During this stretch, the number of large wallets grew consistently, hitting a peak of 1,262 addresses on November 4, 2025.

But things shifted quickly. By November 8, the total dropped to 1,239 addresses—a decline of 23 major wallets in just four days. At the same time, the 30-day change metric flipped negative for the first time in weeks, falling from +49 to -7. This marks a clear reversal in whale behavior.

The data suggests that some of Ethereum's biggest holders are taking profits or reducing exposure at current resistance levels, possibly anticipating short-term volatility ahead.

What's Driving the Whale Shift?

Several factors might explain this trend:

- Profit-taking after the rally: ETH's push above $3,400 likely encouraged whales to lock in gains after a strong quarter.

- Macroeconomic pressure: Concerns around U.S. rate policy and tightening liquidity have made risk assets more volatile lately.

- On-chain positioning: Despite whale outflows, mid-sized wallets holding 1,000–10,000 ETH remain stable, suggesting this is more about redistribution than panic selling.

- DeFi and staking rotation: Some whales may be moving ETH into staking protocols or liquid staking derivatives to optimize yield.

The takeaway? While whale selling might look bearish at first glance, it could also represent smart portfolio rebalancing rather than a large-scale exit.

Market Implications

The real question is whether this selling pressure will continue. Historically, short-term whale reductions have often preceded consolidation rather than sharp drops. If ETH can hold support around $3,200 and the number of mega-wallets stabilizes, the market might resume accumulation heading into 2026.

On the other hand, if whale selling picks up steam, it could push prices toward lower support zones—especially if broader risk sentiment weakens across crypto markets.

Watching Whale Behavior as a Market Signal

Ethereum's mega-whale reduction is the first notable shift in months and could be an early sign of cooling momentum after the recent rally. While some profit-taking is expected after strong gains, sustained outflows from large holders could challenge short-term bullish sentiment.

For now, it's worth monitoring on-chain data closely—especially that 1,239-whale threshold—as a key indicator of confidence among Ethereum's most influential holders. The next few weeks will show whether this is just a breather or the start of a deeper pullback.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir