Ethereum (ETH) supply on exchanges hits a 34-month high as the price surpasses $3,500, driven by expectations of spot ETH ETFs.

ETH Supply on Exchanges Peaks Amid Price Surge

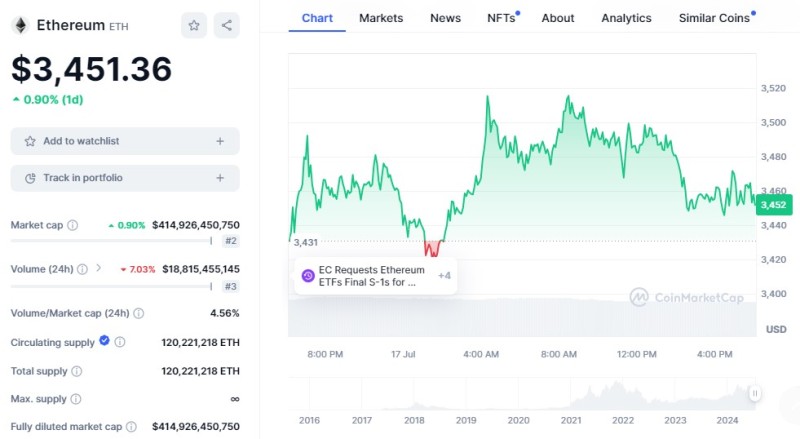

Ethereum (ETH) has seen a significant shift in its market dynamics, with the supply on exchanges reaching a 34-month high. As ETH's price surged past the $3,500 mark, traders and investors are closely monitoring these developments. In the past 24 hours, ETH's price has increased by 0.9%, currently trading at $3,451, and briefly hitting an intraday high of $3,517 earlier today.

The daily trading volume for Ethereum also saw a notable uptick, rising by 7.6% to reach $19.8 billion. This surge in trading activity underscores the heightened interest in ETH as it approaches new price levels. According to Santiment, the supply of Ethereum on exchanges now stands at 19.52 million ETH, a level not seen since September 2021 when ETH was trading at a similar price.

Whale Transactions Decline Despite High Exchange Supply

Interestingly, despite the increase in exchange supply, the number of whale transactions has decreased. Data from the market intelligence platform shows a 12% drop in whale transactions over the past day, from 8,730 to 7,629 unique transactions. This indicates that the rise in exchange supply is being driven by smaller deposits rather than large transactions by major holders.

The Relative Strength Index (RSI) for Ethereum is currently hovering around the 60 mark, as reported by Sentiment. While this suggests that ETH is slightly overbought, it is not yet in a critical position due to its substantial market capitalization, which stands at $419 billion. Investors are keeping a close eye on these indicators to gauge the potential for future price movements.

Spot ETH ETFs Drive Price Optimism

One of the key factors behind the recent price surge is the anticipation of spotting ETH ETFs in the U.S., which are set to begin trading on July 23. The introduction of these investment products is expected to bring more liquidity and institutional interest to Ethereum, further supporting its price growth. Market participants are eagerly awaiting this development, which could have a significant impact on ETH's market trajectory.

In conclusion, as Ethereum navigates these market dynamics, the increasing supply on exchanges and the upcoming launch of spot ETH ETFs are pivotal factors to watch. With its price surpassing $3,500 and trading activity on the rise, ETH remains a focal point for traders and investors. The coming weeks will be crucial in determining whether Ethereum can sustain its upward momentum or if the market will experience a correction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah