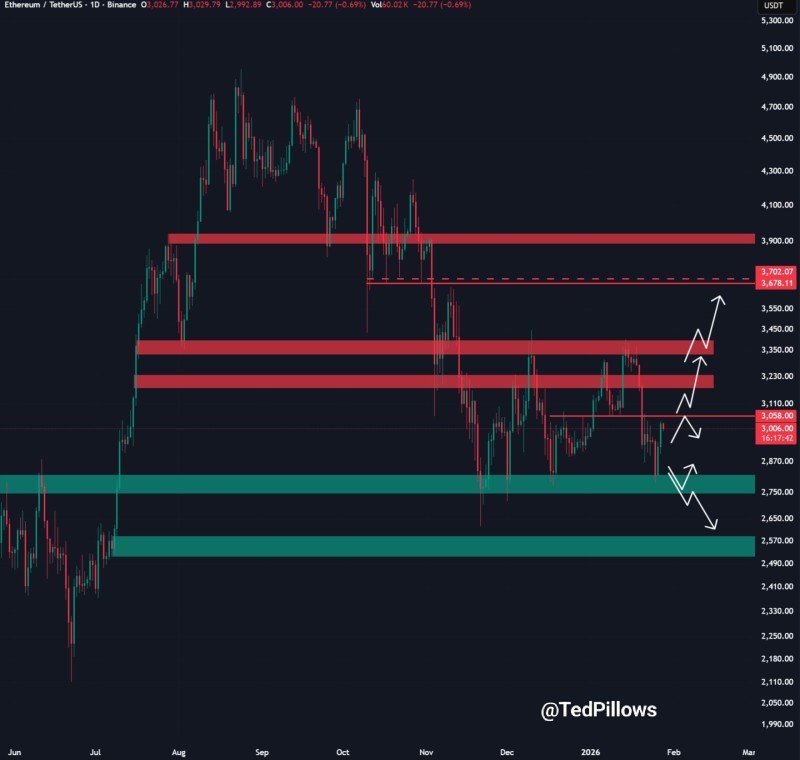

⬤ ETH just punched through the $3,000 mark, putting Ethereum at a make-or-break moment. After spending time stuck below this level during recent sideways action, price has finally pushed above it. But here's the thing—getting above $3,000 is one thing, staying there is another. What matters now is whether ETH can actually close the day above this zone. Without that daily close, this could just be another fake-out.

⬤ Looking at the chart, there's a clear resistance zone sitting just overhead between $3,200 and $3,300. That's where previous rallies ran out of steam. On the flip side, $3,000 is now the line in the sand—it's flipped from being a ceiling to potentially becoming the floor. The chart shows this level has played both roles before, so ETH sitting right on top of it means we're not out of the woods yet. It's still close enough to support that one bad move could send it right back down.

⬤ History on this chart tells a story—past attempts that failed to hold key levels ended badly, with sharp drops back toward lower support zones. If ETH loses $3,000 again, the recent bounce gets wiped out and we're probably headed back down to test those lower demand areas. That would put the bulls right back where they started.

⬤ Why does this matter? Ethereum tends to set the tone for the broader altcoin market. If it can stick above $3,000 on the daily close, higher resistance zones come back into play and momentum stays alive. But if it gets rejected here, expect more choppy range-bound trading and volatility. How ETH handles this level over the next 24 hours will shape what comes next—not just for Ethereum, but for the wider crypto market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah