Ethereum (ETH) price surges over 18% on rumors of a spot ETF approval, significantly impacting ETH options markets.

Ethereum Price Jumps Amid Spot ETF Speculation

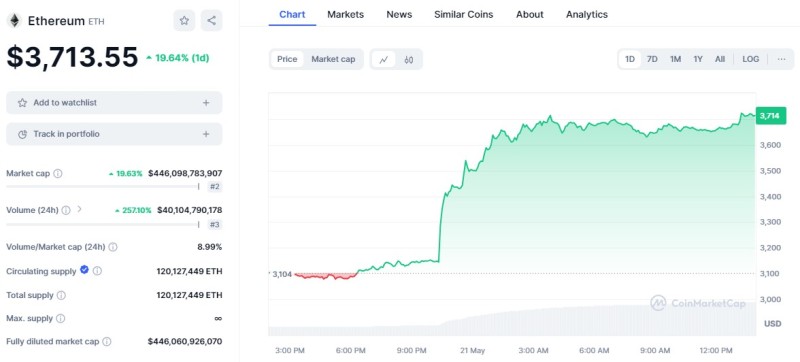

Ethereum's price skyrocketed to a two-month high of $3,700, driven by speculation around the approval of a spot ETH exchange-traded fund (ETF). On May 20, Ether (ETH) surged over 18% following a tweet from Eric Balchunas, a senior analyst at Bloomberg, who increased the probability of the SEC approving an Ethereum ETF from 25% to 75%. Balchunas noted potential political pressure on the SEC to engage more with ETF applicants.

Balchunas revealed that the SEC might be asking exchanges like the NYSE and Nasdaq to update their filings, although there's no official confirmation. Nate Geraci, co-founder of the ETF Institute, mentioned that the SEC's final decision is still pending regarding individual fund registrations (S-1s). According to Geraci, the SEC might approve exchange rule changes (19b-4s) separately from the fund registrations, allowing more time to review the documents beyond the May 23 deadline for VanEck’s Ethereum spot ETF request. This separation could delay the final approval due to the complexities involved with proof-of-stake (PoS) cryptocurrencies.

Impact on Upcoming $3 Billion ETH Options Expiry

The looming decision on Ethereum spot ETFs has intensified interest in ETH options expiries. At Deribit, the leading derivatives exchange, Ether options open interest for May 24 is recorded at $867 million, while for May 31, it reaches a remarkable $3.22 billion. In comparison, CME’s monthly ETH options open interest stands at $259 million, and OKX at $229 million. The call-to-put ratio at Deribit heavily favors call (buy) options, indicating a higher activity in purchasing calls over puts.

If Ether's price stays above $3,600 on May 24 at 8:00 am UTC, only $440,000 of put instruments will be relevant, as selling ETH at $3,400 or $3,500 becomes unnecessary if prices trade above these levels. Call option holders up to $3,600 will exercise their right, resulting in a substantial $397 million open interest favoring calls if ETH remains above $3,600 during the weekly expiry.

High Stakes for Monthly ETH Expiry

The stakes are even higher for the May 31 monthly expiry, with 97% of put options priced at $3,600 or lower, making them worthless if Ether’s price exceeds this threshold. Bullish strategies have significantly benefited from ETH's rally above $3,600. If Ether's price reaches $4,550 by May 31, the net open interest will favor call options by $1.92 billion, while a price of $4,050 will still favor calls by $1.44 billion.

The unexpected 18% increase in Ether's price caught option traders off guard, creating substantial gains for bullish strategies. These profits are likely to be reinvested to maintain the upward momentum, which bodes well for Ether's price following the expiry. The intricate strategies employed by traders, including selling puts for positive exposure or selling calls for a bearish stance, add complexity to predicting the exact market impact.

Overall, the surge in Ethereum's price amid speculation of a spot ETF approval has not only impacted the spot market but also significantly influenced the ETH options markets, setting the stage for continued bullish momentum.

Usman Salis

Usman Salis

Usman Salis

Usman Salis