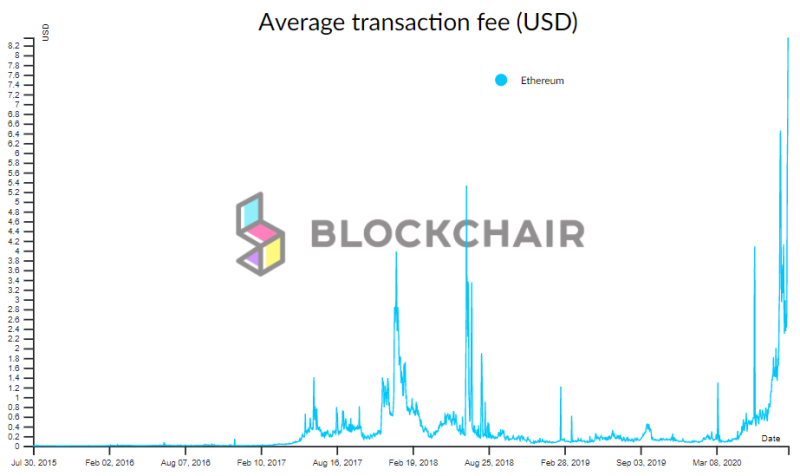

The average transaction fees, that Ethereum users are charged with, have hit a new height of more than $8, according to Blockchain analytical portal, Blockchair. Just recently, the record transaction fee was $7.5. And don't say that it wasn't DeFi's fault.

Ethereum's co-founder, Vitalik Buterin, called for a redesign of the fee structure of the blockchain for a similarly congested period from June to July of 2020, which would imply payments that would weaken network stability.

What Are the Reasons for High Transaction Fees?

The Ethereum blockchain's transaction costs are at historic highs and no one can skip that. Studies also clarify the source of the gas payments on decentralised financial networks — the tokens that miners pay for verifying and activating Ethereum blockchain transactions. Yeah, DeFi plays a part, but the main issue is in the structure.

Many companies, custodians and administrators use MSP (multisignature platforms) to protect their digital capital. Many years ago Multisig was seen as a valuable effort to avoid private keys being stolen. But later on, this approach reduced the bandwidth of the entire Ethereum network.

What Are the Ways to Solve this Problem?

As with any mature market, businesses have experienced increasing scarcity in revenues over time and organizations are looking for ways of expanding their companies at low costs without jeopardizing their protection.

If organizations are able to reevaluate their underlying infrastructure and come up a solution, which does not rely on the assistance of a single blockchain, they will be able to easily cut the spendings and reduce technology's set-up costs. Payments of gas fees merely to model multistructure on Ethereum will be part of the past.

And while this is happening, many leaders in the crypto market are offering their solutions to this problem. For example, the founder of the cryptocurrency exchange Binance hinted about the need to use their product.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov