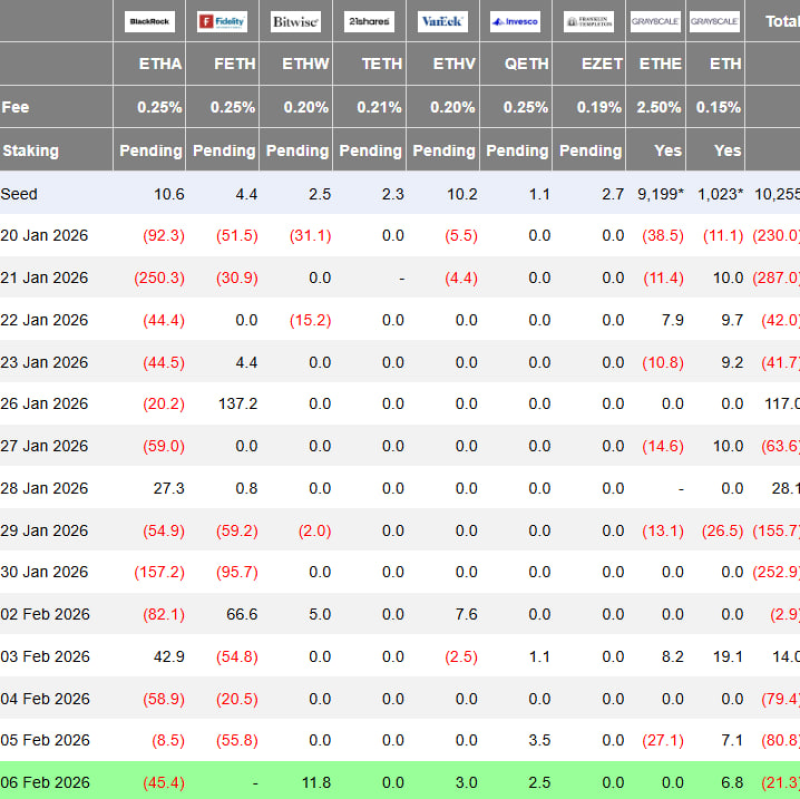

⬤ Ethereum ETFs flipped negative with a net outflow hitting $21.3 million in the latest trading session. The selling pressure came almost entirely from BlackRock, which dumped roughly $45.4 million in Ethereum exposure.

⬤ The flow breakdown shows a split picture across different issuers. A handful of funds pulled in small amounts of capital while others stayed flat, but none of it mattered—BlackRock's exit was too big to offset. This wasn't broad-based selling; it was one massive institutional move dictating the entire day's numbers.

⬤ Compared to BlackRock's transaction size, other ETF providers barely registered. The math is simple: one huge outflow plus a bunch of tiny inflows still equals red for the day.

⬤ This underscores how a single whale can swing ETF flow headlines and potentially impact Ethereum's price momentum. Even when most funds are holding steady or seeing modest interest, one major player cashing out can flip the entire narrative for Ethereum ETFs and add short-term pressure on ETH market sentiment.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah