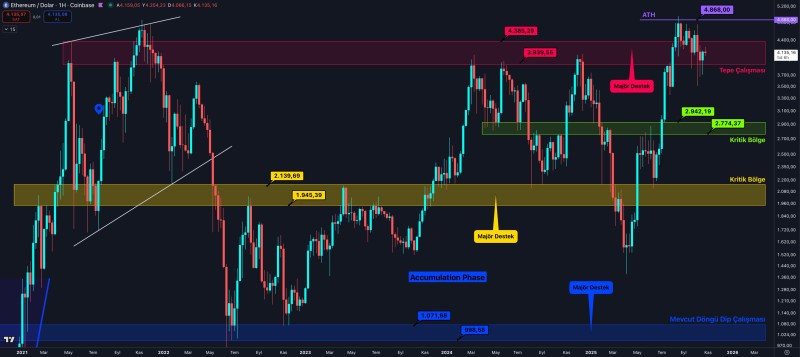

Ethereum (ETH) finds itself at a pivotal moment, consolidating within a tight range that could determine its trajectory ahead. The asset is caught between resistance near $4,385–$4,868 and support around $2,774–$2,942. After weeks of choppy trading, investors remain cautious, waiting for signals about whether ETH will push toward all-time highs or enter a deeper correction.

Chart Analysis Shows Compression Near Historical Peaks

According to trader Berke Oktay, Ethereum's price has entered a compression phase, trading between well-defined resistance and support zones. The area spanning $3,939 to $4,385 represents major resistance where selling pressure has historically intensified, while the $4,868 line marks Ethereum's all-time high.

On the downside, two critical support areas stand out: $2,774 to $2,942 as the immediate defense line where buyers have shown interest, and a deeper zone between $1,945 and $2,139 that's held as a major base since early 2023.

Neutral Sentiment Before the Next Move

The current range reflects neutral market sentiment as traders await a catalyst. If Ethereum holds above $2,940 and rebuilds momentum, a retest of $4,385 becomes likely, potentially followed by another attempt at the $4,868 all-time high. Conversely, failure to defend $2,774 could trigger selling pressure toward the $2,100–$1,950 support cluster.

Ethereum is suspended between major historical resistance and solid institutional support, a setup often seen before significant directional moves in crypto. With volatility compressed and liquidity building, the coming sessions could reveal whether Ethereum prepares for another leg up or enters a deeper corrective phase.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov