Dogecoin (DOGE) took a hit on Monday, falling 5% over 24 hours as trading volume exploded. Traders are watching to see if the meme coin can hold above $0.198 or slide further to $0.185.

Dogecoin (DOGE) Price Gets Hammered by Heavy Selling

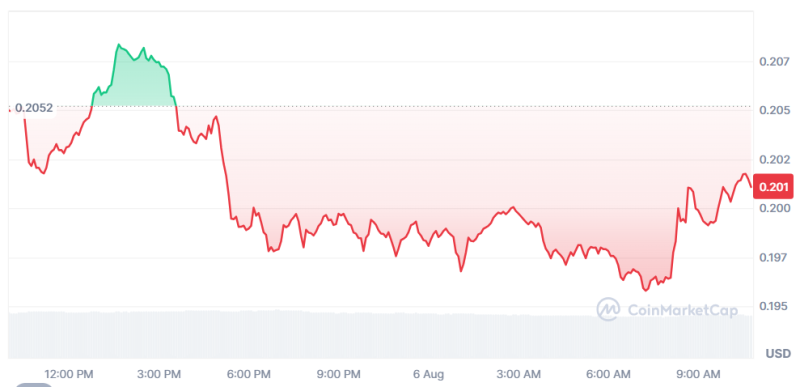

DOGE had a rough day, dropping from $0.21 to $0.20 between August 4 at 21:00 and August 5 at 20:00. The coin bounced around in a $0.013 range, hitting lows of $0.198 and highs of $0.211. Things got wild at 14:00 on August 5 when volume exploded to 877.9 million — almost four times the usual daily average of 268.85 million. This massive selling pushed DOGE below the important $0.201 support level.

DOGE ended at $0.1985, unable to climb back up despite several tries. This screams institutional selling and shows bears are in control. The whole crypto market is getting crushed as investors run from risk, with crypto ETFs seeing $223 million in outflows over the past week according to CoinShares data.

DOGE Volume Shows Bears Winning

The meme coin space is struggling as retail traders lose interest and big players cash out. DOGE looked ready for a rally last week, but breaking below $0.205 killed that idea completely.

DOGE started Monday strong, hitting $0.211 around 01:00 before everything went sideways. The biggest damage happened at 14:00 when price crashed from $0.205 to $0.199 on that monster volume spike. Then at 19:51, another wave knocked it down to $0.1975 on 19.04 million in volume — over 70 times the normal hourly amount.

Now $0.205 has become a ceiling DOGE can't break through. The price is sitting near daily lows with no real signs of a turnaround.

What's Next for Dogecoin (DOGE) Price?

DOGE traded in a 6% range between $0.198 and $0.211. That huge volume spike at 14:00 shows big players were involved in the selloff. The weak bounce volume around $0.198-$0.199 suggests buyers aren't stepping up.

Traders are watching whether DOGE can hold above $0.198 or if selling will push it to the next target at $0.185. If it can't get back above $0.201, we could see more stop-losses getting hit. With volume spiking on every drop and fading on bounces, sellers are calling the shots.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah