Dogecoin has hit a rough patch as major investors dump massive amounts of tokens, creating uncertainty about where the popular meme coin heads next. After a strong rally earlier this month, large holders are now taking profits, leaving regular investors wondering if the party is over.

Recent Market Activity

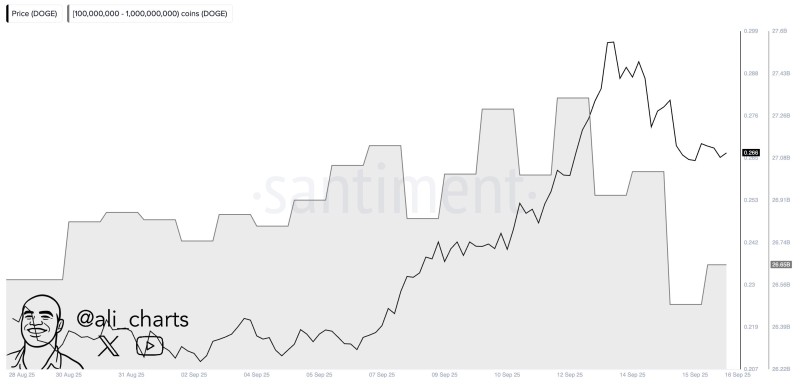

Over the past four days, cryptocurrency whales have sold more than 680 million DOGE tokens, according to data from Ali. These large wallets, holding between 100 million and 1 billion coins, significantly reduced their positions during a 96-hour period. At current market prices, this massive sell-off represents over $180 million worth of Dogecoin hitting the market.

The timing couldn't be more telling. These sales coincided perfectly with DOGE's recent peak at $0.29 on September 13, suggesting that smart money decided to cash out near the top of the rally.

Technical Analysis

The price action tells a clear story. DOGE spiked to $0.29 before reversing sharply under the weight of whale selling pressure. The $0.29 level has now emerged as strong resistance, with sellers stepping in aggressively at this price point. Currently, the coin has found some stability in the $0.25-$0.26 range, where buyers appear to be making a stand.

This support zone will be crucial for DOGE's near-term direction. If it holds, bulls might get another shot at breaking through the $0.29 ceiling. If it fails, the next logical support sits around $0.23 or potentially lower.

Why the Sudden Exit?

The whale exodus makes sense from a profit-taking perspective. DOGE rallied nearly 40% in early September, giving large holders substantial gains to protect. Additionally, the broader crypto market has cooled off as Bitcoin lost steam, creating a natural exit opportunity for cautious investors.

Another factor is the lack of retail participation. While whales were accumulating earlier this month, everyday investors haven't matched that enthusiasm, leaving DOGE vulnerable when large holders decide to sell.

Peter Smith

Peter Smith

Peter Smith

Peter Smith