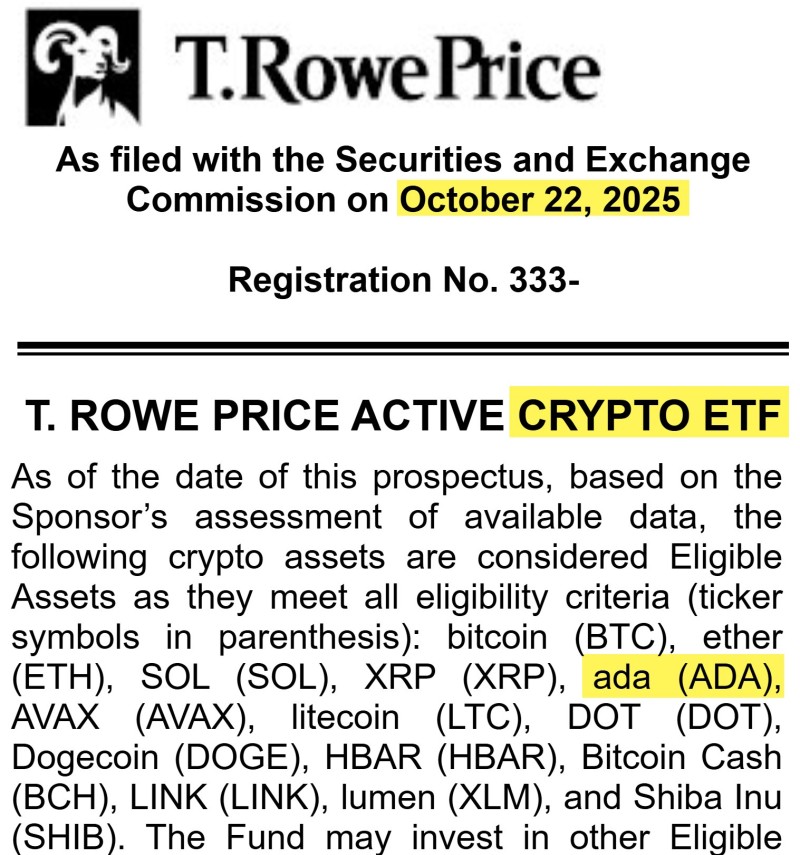

One of Wall Street's most respected investment firms has just made a major move that could reshape how traditional finance views digital assets. On October 22, 2025, T. Rowe Price filed for an Active Crypto ETF with the U.S. Securities and Exchange Commission, and Cardano (ADA) made the cut as one of the eligible cryptocurrencies.

Institutional Recognition for Cardano

The SEC filing reveals that T. Rowe Price plans to actively manage exposure across several pre-selected cryptocurrencies that meet specific eligibility and liquidity standards. As St₳ke with Pride, a prominent Cardano community account, highlighted in their announcement, the fund will include major digital assets like Bitcoin, Ethereum, Solana, XRP, Avalanche, Litecoin, Dogecoin, Polkadot, and of course, Cardano.

This represents a watershed moment for Cardano. Despite being praised for its research-driven approach and peer-reviewed development process, ADA has sometimes been overshadowed by other blockchains when it comes to institutional attention. By securing a spot in a T. Rowe Price product, Cardano is now being treated as an asset worthy of serious institutional consideration, suggesting that major financial players are starting to recognize its long-term potential.

Why This Filing Matters

What sets the T. Rowe Price Active Crypto ETF apart from existing spot ETFs is its management style. Rather than simply tracking the price of a single cryptocurrency, this fund gives portfolio managers the freedom to adjust allocations based on market performance, volatility trends, and changing conditions. It's an approach that signals maturity in how institutions are thinking about crypto—not as a gamble, but as part of a balanced investment strategy.

For Cardano specifically, this could mean increased liquidity, wider visibility among traditional investors, and fresh market momentum. When institutional products enter the picture, they typically bring higher trading volumes and deeper integration into the broader financial system.

Community Response and Market Context

The Cardano community has responded enthusiastically to the news. The reaction reflects a sense of validation, with many supporters viewing this as proof that ADA belongs in conversations about the future of institutional crypto investing. The timing couldn't be better either, as Cardano continues to roll out network upgrades, expand its DeFi ecosystem, and attract more developers to build on the platform.

A Broader Shift in Institutional Crypto Exposure

T. Rowe Price isn't alone in exploring crypto-related products. Firms like BlackRock, Fidelity, and Franklin Templeton have all entered the space in recent years. However, the active management structure of this particular ETF is notable because it shows an intention to strategically navigate the crypto market rather than just passively hold assets. By including a diverse range of cryptocurrencies—from established giants like Bitcoin and Ethereum to innovation-focused platforms like Cardano and Solana—T. Rowe Price is betting on blockchain diversity as a smart investment thesis.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov