Cardano (ADA) is rallying hard with trading volume up 92% and price hitting $0.86, even as online controversy swirls around the project.

Cardano's back in the spotlight, and it's not just because of tech updates this time. ADA has caught everyone's attention as trading volume absolutely exploded by 92%, right alongside some serious online drama involving the project. But here's the thing – despite all the Twitter chaos, ADA's price is telling a completely different story.

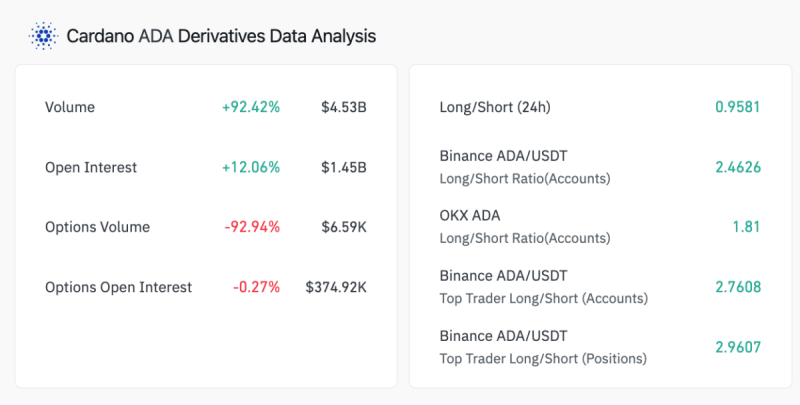

The token shot up to $0.86 with a solid 4.6% daily gain, continuing the uptrend that started earlier this month. What's really interesting is the derivatives data backing this move. Futures trading volume hit $4.53 billion while open interest jumped 12.06% to $1.45 billion. That's serious money flowing in, suggesting both big players and regular traders think there's more upside coming.

ADA Derivatives Show Strong Bullish Signals

The numbers don't lie – Cardano's derivatives market is heating up big time. Funding rates climbed to 0.0285, which basically means long traders are willing to pay short traders to hold their positions. That's a classic bullish signal.

Over on Binance, the big traders are going long in a major way. The Long/Short ratio is sitting at nearly 3:1, meaning for every trader betting against ADA, there are three betting it goes higher. When smart money positions like this, it usually means something's brewing.

Open Interest also crossed 700 million before settling down, showing there's real speculative activity happening. It's not just retail FOMO – institutional money is flowing in too.

Drama Doesn't Stop ADA Price Rally

Here's where things get spicy. All this trading action is happening while Cardano's dealing with some serious online drama. An email's been making rounds accusing a Cardano employee of enabling fraud, with user Robin Engraf claiming he got scammed on a fake trade withdrawal. He even went as far as saying "your company allows and supports theft."

Charles Hoskinson wasn't having any of it. The Cardano founder came out swinging on X (Twitter), firing back: "Will he apologize for falsely accusing me of stealing money from him? No, he won't… Thus public humiliation is the only deterrent."

The wild part? Instead of hurting ADA's price, all this controversy seems to be bringing more attention to the project. Sometimes bad publicity really is better than no publicity in crypto land.

Technical Indicators Suggest ADA May Cool Off Soon

Now for the reality check. While ADA's looking strong, the technicals are flashing some warning signs. The RSI hit 82.17, which puts it deep in overbought territory. Anything above 80 usually means a cooldown is coming.

The MACD is still showing bullish momentum though, so the overall trend remains positive. Volume's been solid throughout this rally, which is good news for sustainability.

Bottom line: ADA might need to take a breather before pushing higher. A pullback to around $0.80 or $0.75 wouldn't be surprising and could actually set up the next leg up if the bulls stay in control.

Peter Smith

Peter Smith

Peter Smith

Peter Smith