Bitcoin (BTC) tumbles to $86,805, marking its biggest intraday drop since August. Investor concerns over Trump's trade policies and macroeconomic uncertainty fuel market volatility.

BTC Plunges to Lowest Since November

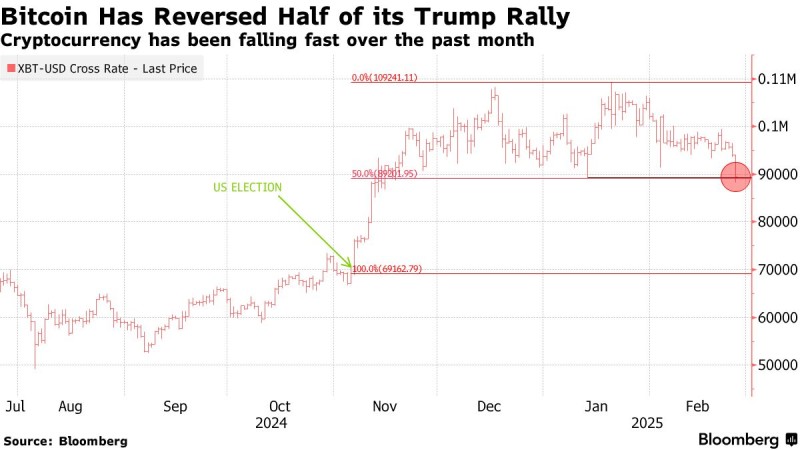

Bitcoin (BTC) has fallen sharply below the $90,000 mark, hitting its lowest level since mid-November as the recent rally fueled by Donald Trump’s election win reverses. The leading cryptocurrency dropped 8.5% on Tuesday, its biggest intraday decline since August, before stabilizing at $86,805 by 11:20 a.m. in New York. Other major digital assets, including Ethereum (ETH), XRP, and Solana (SOL), also posted losses, with a broader index of top cryptocurrencies on track for its worst four-day decline since early August.

Trump’s Trade Policies Shake BTC Market Confidence

The recent downturn in BTC comes amid rising investor concerns over geopolitical risks and macroeconomic uncertainty following Trump's inauguration. Bitcoin has now shed nearly 20% since January, as Trump's aggressive trade stance and newly announced tariffs weigh on market sentiment.

“The fall in Bitcoin prices is likely related to broader macro uncertainty that has hit most financial markets in the last couple of days and is linked to the various tariffs being announced by President Trump,” said Adrian Przelozny, CEO of crypto exchange Independent Reserve.

The selloff in BTC mirrors the broader market retreat, with the Nasdaq 100 suffering its worst four-day drop since September. Investors have shifted capital into bonds, pushing the 10-year Treasury yield lower for five consecutive sessions.

Spot Bitcoin ETFs See Record Withdrawals

Investor sentiment in BTC has also been dampened by significant outflows from Bitcoin-focused exchange-traded funds (ETFs). On Monday, the iShares Bitcoin Trust ETF (IBIT), the largest spot BTC fund, recorded a rare $158 million outflow. The Fidelity Wise Origin Bitcoin Fund saw investors pull nearly $250 million, marking the third-largest withdrawal among all ETFs.

Bloomberg Intelligence data shows that more than $956 million has exited US-listed spot Bitcoin ETFs in February, making it the worst month on record for the category.

BTC Liquidations Surge as Traders Face Heavy Losses

The sharp BTC decline has triggered massive liquidations across crypto markets. According to Coinglass, over the past two days, leveraged traders faced liquidations totaling $815.8 million and $860 million, respectively.

Perpetual futures, which offshore investors widely use due to their lack of availability in the US, saw a steep drop in leveraged long positions.

“Perp traders showed an appetite to add BTC longs, but longs have largely been punished as BTC pushed to new yearly lows amidst substantial long liquidations,” said Vetle Lunde, head of research at K33 Research. “Aggressive positioning from offshore traders has created an environment ripe for continued volatility.”

As Bitcoin (BTC) struggles to regain ground, traders and investors remain cautious amid ongoing economic uncertainty and shifting regulatory landscapes.

Peter Smith

Peter Smith

Peter Smith

Peter Smith