Bitcoin (BTC) tumbles below $62,000, triggering the liquidation of over 45,000 traders, as meme coins like BONK, PEPE, and FLOKI bleed out.

Bitcoin's Bearish Turn

The much-anticipated Sunday gains in the cryptocurrency market have swiftly evaporated, with Bitcoin (BTC) leading the descent. After briefly soaring above $64,000, BTC failed to sustain its momentum, plunging to a 10-day low below $62,330. The sudden downturn has sent shockwaves across the market, triggering panic selling and liquidating over 45,000 over-leveraged traders within the past 24 hours.

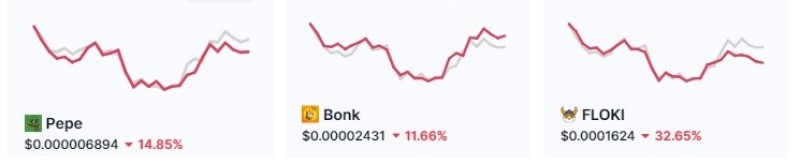

As Bitcoin struggles to regain its footing, altcoins are enduring even steeper declines. Solana (SOL) spearheads the downward spiral with a 5% drop, plummeting to $136. Ethereum (ETH), previously a standout performer, has retraced by 3.2%, teetering around the $3,200 mark. However, the most striking losses are observed in the meme coin sector, with BONK witnessing a nearly 10% decline, followed closely by PEPE (-8.5%) and FLOKI (-7.5%).

Traders Reel from Liquidations

The sharp market downturn has inflicted substantial losses on over-leveraged traders, with liquidations surpassing 45,000 in the past day alone. The collective value of these liquidated positions exceeds $100 million, with the largest single liquidation event, worth nearly $3 million, occurring on OKX. The widespread liquidations underscore the inherent risks of trading in volatile market conditions.

In conclusion, amid the prevailing bearish sentiment, there are glimmers of optimism for Bitcoin's recovery. Despite the recent downturn, positive developments within the Bitcoin ecosystem offer the potential for a reversal in the current trajectory. As market participants navigate the choppy waters, all eyes remain on Bitcoin's next move and its ability to reclaim lost ground.

Peter Smith

Peter Smith

Peter Smith

Peter Smith