Bitcoin ETFs face significant outflows totaling $228.2 million, with BlackRock's IBIT ETF bucking the trend. Explore the market dynamics and investor sentiments driving these movements.

Bitcoin ETF Outflows Surge to $228 Million

Bitcoin ETFs have witnessed a dramatic shift as substantial outflows totaling $228.2 million occurred recently. According to Farside Investors, the US Bitcoin spot ETF market saw net outflows of $226.2 million yesterday, signaling a potential shift in investor sentiment.

In a contrasting development, BlackRock’s IBIT ETF attracted new investments, reporting a net inflow of $18.2 million. This exception highlights the differing perceptions and confidence levels among investors towards various Bitcoin ETFs. While most funds experienced withdrawals, IBIT's performance indicates that some investors still see potential in specific Bitcoin ETFs amidst the volatility.

Detailed ETF Performance and Regulatory Insights

The cryptocurrency market saw significant shifts with 11 spot Bitcoin ETFs reporting massive outflows amounting to $226.21 million. Fidelity’s FBTC faced one of the largest hits, with a single-day outflow of $106.4 million, marking its second-largest since inception. Grayscale’s GBTC fund followed closely with net outflows of $61.5 million.

Other prominent funds such as Ark Invest and 21Shares’ ARKB saw $52.7 million flow out, while Bitwise and VanEck lost approximately $10 million each. Smaller outflows were recorded from Invesco and Galaxy Digital’s BTCO at $2.7 million. Despite these substantial outflows, the 11 funds have collectively amassed $15.30 billion in net inflows since their launch in January, demonstrating the overall resilience and ongoing interest in Bitcoin ETFs.

Bitcoin Price Trends and Market Dynamics

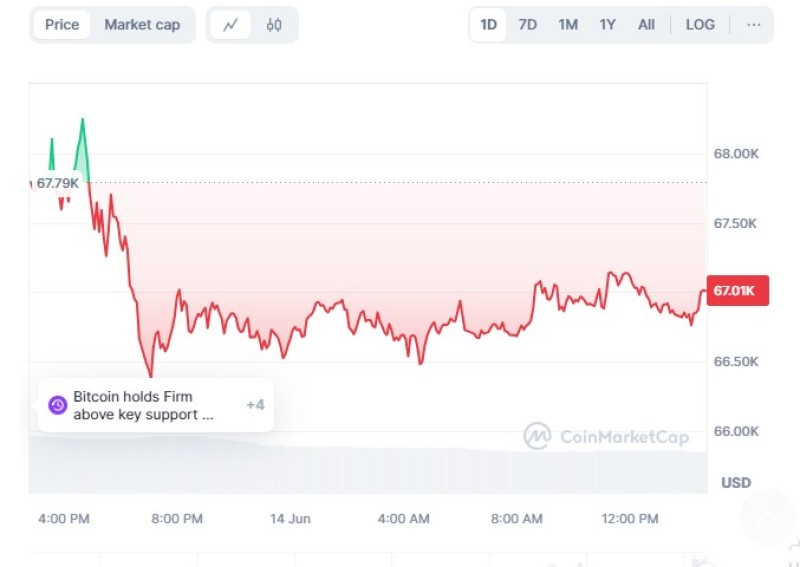

Bitcoin’s price has been volatile, recently flirting with the $72,000 mark before slipping nearly 6.5% over the past week. Currently trading around $67,01, Bitcoin saw over $26 billion in trading volume in the past 24 hours, reflecting a 0.77% decline on the day. The cryptocurrency’s market cap remains robust at $1.3 trillion, despite recent fluctuations.

Market data from Santiment indicates a spike in buyer interest after Bitcoin dipped below $67,000, marking the second-largest buying interest in two months. This increased buying activity contrasts with a lack of significant selling pressure, suggesting a potentially bullish outlook.

Whale Accumulation and Miner Activity

Notably, the number of Bitcoin whales—addresses holding over 1,000 BTC—has reached an all-time high, driven by continued institutional investment. However, miners have been offloading larger quantities of Bitcoin to cover operational costs following the recent halving event. This miner activity has contributed to the current market dynamics and price movements.

According to analyst Rekt Capital, Bitcoin’s inability to break out decisively could be beneficial for the longer market cycle. Historically, Bitcoin has not made significant moves immediately after a halving event, suggesting that the current period of consolidation may set the stage for future gains.

Conclusion

Despite recent outflows and price volatility, Bitcoin’s long-term trajectory remains promising, bolstered by historical patterns and ongoing whale accumulation. As the market navigates these turbulent times, investors continue to watch closely, balancing short-term fluctuations with potential long-term gains.

Peter Smith

Peter Smith

Peter Smith

Peter Smith