Silver's been on a tear lately, and it doesn't look like it's stopping anytime soon. The technical picture, especially through the lens of Elliott Wave theory, shows a classic impulsive move that's keeping the momentum firmly pointed up.

Elliott Wave Analysis Points to More Upside

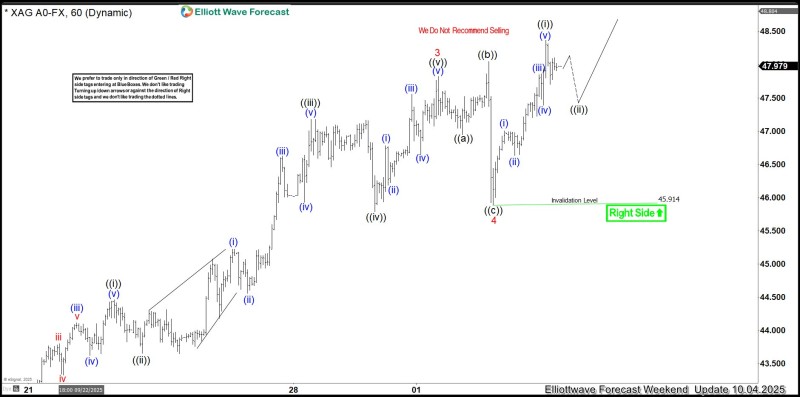

Market analyst Elliottwave Analysis notes that as long as we're holding above that $45.9 level, the bulls are in control, and any pullbacks might actually be chances to get in rather than reasons to worry.

Looking at the wave count, silver's wrapped up a correction and is now extending into what appears to be a fresh bullish leg. Here's what stands out:

- Critical support sits at $45.9 – that's the line in the sand. If price breaks below, the current bullish setup falls apart.

- Dips could find buyers around typical Elliott Wave pullback zones – think 3, 7, or 11-swing retracements where corrective patterns tend to bottom out.

- Silver's hovering near $48 right now, and if it punches through $48.5, we could be looking at an acceleration toward even higher ground.

The structure right now suggests we're early in a new upward sequence, which means there's potentially a lot more juice left in this move.

What's Driving Silver's Strength

It's not just the charts telling a bullish story. There are real-world factors backing this rally. Investors are flocking to safe-haven assets as global uncertainties pile up and inflation concerns linger. Silver's also got a dual identity – it's not just a store of value, but a key industrial metal used heavily in solar panels and electronics, which means demand isn't just about fear, it's about growth too. Add in a softening dollar and the possibility of easing interest rates, and you've got a pretty solid backdrop for precious metals to shine.

As long as that $45.9 support level holds firm, the wave structure says silver's got room to climb. Any short-term weakness should probably be seen as a setup for the next leg up rather than a reversal signal. The next target on the radar is around $49, and if momentum keeps up, we could see silver push even higher before the year wraps up. Traders might want to keep an eye on those corrective dips as potential entry points rather than exit signals.

Peter Smith

Peter Smith

Peter Smith

Peter Smith