Silver (XAG) has powered past $33 per ounce and is sitting pretty with a 3% weekly gain, thanks to nervous investors fleeing to safety and China's solar boom eating up industrial demand.

Silver (XAG) Finally Breaks Free as America's Money Problems Get Real

Silver just punched through the $33 barrier on Friday like it was made of paper, and honestly, it's been a long time coming. The shiny metal is cruising toward a solid 3% weekly gain that's got precious metals traders doing happy dances across trading floors worldwide.

What's driving this rally? Well, it's pretty simple – people are getting seriously spooked about America's spending habits. Trump's latest budget proposal is basically a financial horror movie: massive tax cuts paired with even bigger defense spending increases. Do the math, and you're looking at deficits that would make a lottery winner blush and national debt numbers that belong in a sci-fi movie.

When Uncle Sam starts looking financially sketchy, smart money runs straight to precious metals. Silver, being gold's scrappier little brother, tends to move even more dramatically when fear kicks in. The fact that XAG is holding strong above $33 tells you this isn't just some random spike – there's real conviction behind this move.

"We're seeing classic flight-to-quality behavior," one veteran metals trader told me this morning. "When government finances look shaky, silver becomes everyone's favorite insurance policy."

Fed's Dovish Signals Could Send Silver (XAG) to the Moon

Just when silver needed another boost, Federal Reserve Governor Christopher Waller came through with some seriously bullish comments. The guy basically hinted that rate cuts are still on the table for later this year, though he's tying it to how Trump's tariff drama plays out.

Here's the thing about lower rates and silver – they go together like peanut butter and jelly. When you can't make decent money on bonds or savings accounts, suddenly holding a chunk of non-yielding metal doesn't seem so crazy. Plus, rate cuts usually trash the dollar, making silver cheaper for buyers using other currencies.

The tariff angle is particularly juicy. If Trump's trade war threats turn out to be more bark than bite, the Fed gets more room to cut without worrying about inflation going bonkers. That's basically Christmas morning for silver bulls who've been waiting for this kind of monetary policy shift.

Smart money is already positioning for this scenario. Every Fed official who opens their mouth between now and the next policy meeting could move silver prices, and XAG is sitting in the perfect spot to capitalize on any dovish surprises.

China's Solar Explosion Creates Massive Silver (XAG) Appetite

While everyone's focused on the safe-haven story, there's this absolutely massive industrial demand surge happening that most people are missing. China just dropped some mind-blowing numbers: their wind and solar capacity hit nearly 1,500 GW in the first quarter alone, with solar installations jumping by a ridiculous 60 GW.

Why should silver investors care? Because every single solar panel needs several grams of silver to work properly. When China – the world's factory – cranks out 60 GW worth of solar panels in three months, we're talking about millions of additional ounces of silver demand hitting the market.

This isn't some one-time thing either. China's renewable energy push is just getting warmed up, with government targets that would make your head spin. We're looking at sustained industrial demand that could support silver prices for years, not months.

"The renewable energy transition is silver's best friend," explains one commodity analyst who's been tracking this trend. "Every solar panel, every electric vehicle, every green technology project needs silver. China's acceleration is creating demand we haven't seen since the tech boom."

The timing couldn't be more perfect. Just as financial chaos drives safe-haven buying, real-world consumption is exploding. That's the kind of fundamental support that turns short-term rallies into long-term bull markets.

Silver (XAG) Charts Look Like They're Ready to Explode

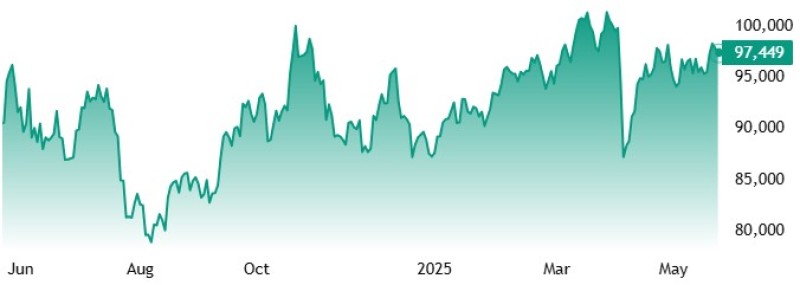

From a technical perspective, silver breaking $33 is huge – and I mean HUGE. This level has been a brick wall for XAG multiple times over the past year. Seeing silver finally smash through with conviction suggests the bulls have finally taken control of this market.

The 3% weekly gain isn't just about Friday's action either. We've seen steady buying pressure all week long, which tells you this isn't some random short squeeze or algorithm gone wild. This looks like institutional money making calculated bets on higher silver prices.

Volume has been impressive too, with way more shares changing hands than usual. When breakouts happen on heavy volume, they tend to stick around longer than those fluky moves that happen when nobody's paying attention.

Chart jockeys are already eyeing $35 as the next major target for silver. If this momentum keeps up and the fundamental story stays intact, XAG could test that level faster than anyone expects. The key thing to watch is whether silver can hold above $33 if it pulls back – that would confirm this level has flipped from resistance to support.

Why Silver (XAG) Could Keep Running Higher

Looking ahead, everything that's pushing silver higher right now isn't going anywhere anytime soon. America's fiscal mess is getting worse, not better. China's solar buildout is accelerating, not slowing down. And the Fed seems increasingly willing to cut rates if trade tensions ease up.

The historical relationship between gold and silver also suggests XAG has more room to run. The gold-to-silver ratio, while improving, still shows silver is relatively cheap compared to its flashier cousin. If safe-haven demand keeps building, silver's higher volatility could turn into a massive advantage.

But here's what really sets silver apart: it's the only precious metal that's also essential for the green energy revolution. Gold might be prettier, but silver is literally irreplaceable in solar panels, electric vehicles, and all the tech that's supposed to save the planet.

"Silver is having its moment," one longtime metals investor told me. "It's got the safe-haven bid like gold, but also this incredible industrial story that gold just can't match. This could be the beginning of something really special."

With XAG now comfortably above $33 and showing no signs of backing down, the stars seem aligned for potentially much higher prices. Whether silver can keep this party going depends on how the fiscal drama in Washington plays out and whether China's renewable push continues at this breakneck pace.

For now though, silver is the precious metal that's actually living up to its precious status. And at $33+ per ounce with a 3% weekly gain in the books, XAG is making a pretty compelling case that this rally is just getting started.

Usman Salis

Usman Salis

Usman Salis

Usman Salis