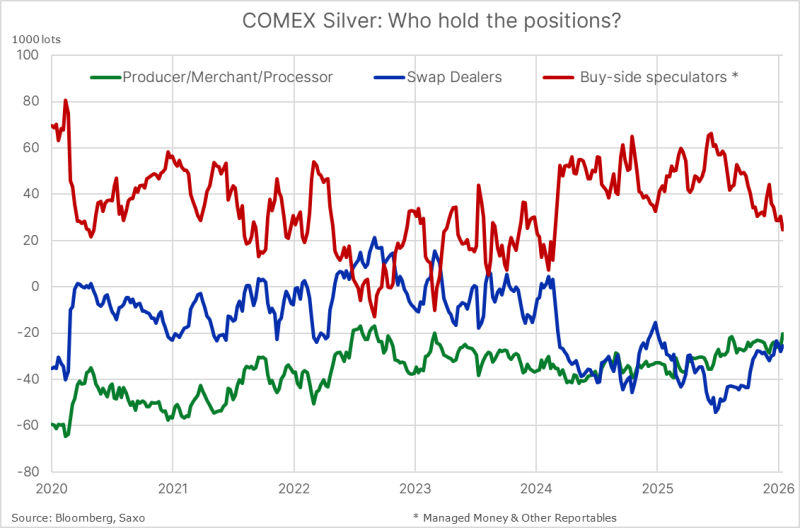

⬤ Silver positioning on COMEX has shifted dramatically, with producers now driving short-covering activity rather than banks. Banks typically hold offsetting long positions against shorts, keeping exposure neutral, while producers are scrambling to adjust hedges as prices climb and volatility spikes. The positioning breakdown shows how producers, swap dealers, and speculators have moved since 2020.

⬤ Producer, merchant, and processor positions stay structurally net short but fluctuate significantly. In the week through January 20, producer and merchant net positions jumped by 5,762 contracts to minus 20,218 contracts. Surging silver prices and wild volatility have made hedging brutally expensive for producers, especially when margin requirements spike during sharp price swings.

⬤ Swap dealers shifted exposure too, with net positions climbing 2,716 contracts to minus 25,309. Swap dealers usually maintain offsetting positions tied to client trades, which shields them from forced covering. Meanwhile, managed money and other reportable traders went longer, adding 6,000 contracts to reach plus 24,615 as speculative appetite grew.

⬤ These moves matter because they show how different players react when conditions change. Producer hedging shapes the futures market structure, particularly when prices stay elevated and volatile. As producers pull back hedges under margin pressure, risk distribution across silver markets shifts, impacting liquidity and price sensitivity. The data highlights how positioning mechanics—not just directional bets—are reshaping COMEX silver dynamics.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi