Silver (XAG) has broken through the $50 barrier and shows no signs of slowing down. This rally isn't just about speculation - it reflects genuine confidence in silver's dual role as both a safe-haven play and an industrial workhorse. The metal's momentum has turned heads across trading desks and investment circles alike.

Why This Rally Stands Out

Trader George highlighted the exceptional speed of this rally, describing it as a "crazy run." He's holding onto all his silver positions for now but plans to start taking profits once prices push above $70. Even among bulls, there's a growing sense that caution may be warranted as silver approaches levels not seen in years.

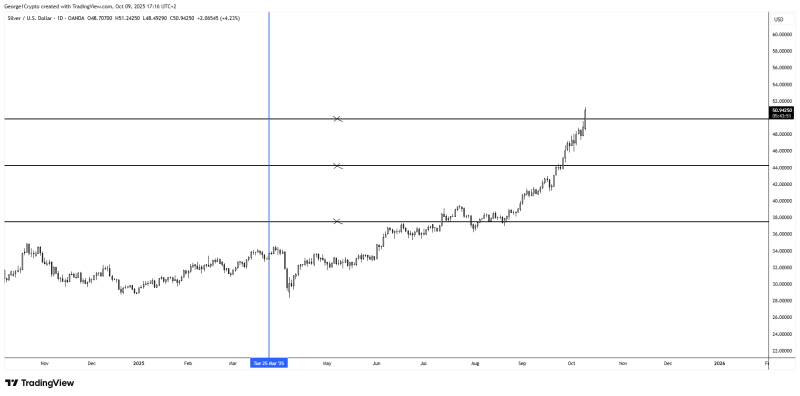

The chart paints a clear picture of strength. Support has formed around $38 and $44 - areas that used to cap rallies but now act as floors. Silver is trading above $50.90, with the next resistance sitting near $52. If that level breaks, the road to $70 opens up considerably. The pattern of higher highs and higher lows suggests strong hands are behind this move, not just retail hype.

Several forces are pushing silver higher. Inflation fears are driving investors toward precious metals as a hedge. On the industrial side, demand from renewable energy and electronics keeps fundamentals solid. Meanwhile, expectations of a softer dollar and lower rates have given the rally extra legs.

What's Next for Silver?

The trend looks strong, but expect some choppiness as silver tests overhead resistance. If it can hold above $50 and consolidate, that would set up a solid base for a run at $70 - a target many see as achievable in the medium term.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah