After years of consolidation, silver (XAG) has staged a remarkable long-term recovery that technical analysts have been watching closely since its extended compression phase began in 2020. Recent chart data indicate the metal has completed a four to five-year technical formation, surging above its multi-year structure before entering a mild correction phase.

Chart Analysis: Momentum Eases While Structure Holds

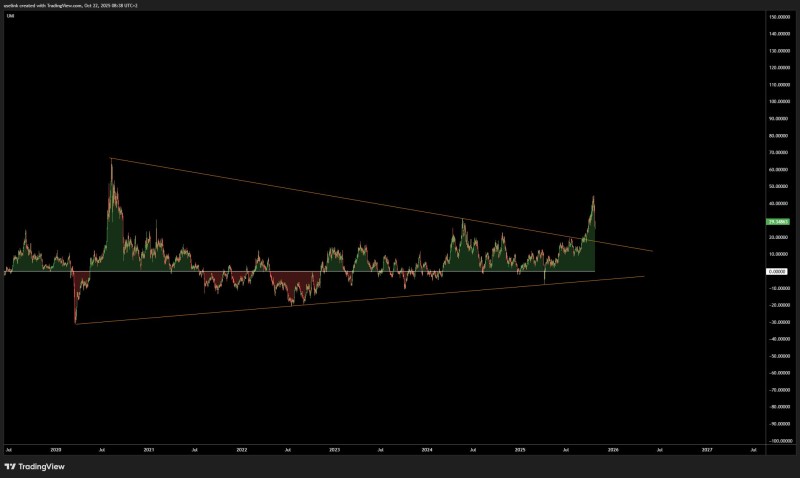

The chart illustrates a broad wedge pattern defining silver's price action since mid-2020. Over several years, the metal oscillated between a descending upper trendline and a rising support base, gradually tightening its range until a decisive upward move occurred in 2025. After breaking out, silver climbed toward the $40 region before pausing near $29.30, where it currently trades.

This correction appears to be part of a normal consolidation, with the upper resistance line now potentially serving as structural support. The lower boundary of the previous formation remains intact, suggesting long-term bullish momentum is unbroken. Market observers, including trader UseliNk, interpret this type of pullback as momentum pulling back after a major breakout, with the asset cooling off before potentially preparing for another upward leg.

Technical analysts note this type of pullback often reflects profit-taking and momentum reset phases typical of commodities entering mid-cycle growth. If silver maintains support above the $25 to $27 zone, it could stabilize and prepare for renewed strength heading into 2026.

Broader Market Context

Silver's long-term resilience is underpinned by broader macroeconomic forces: persistent inflation concerns, a weakening U.S. dollar, and rising industrial demand, particularly from renewable energy and electronics sectors. With central banks moving cautiously on rate cuts, investor appetite for tangible, supply-constrained assets like silver has remained firm. Analysts view silver's performance as part of a larger commodity cycle revival, where metals tied to both monetary and industrial value may outperform traditional assets over the next few quarters.

Peter Smith

Peter Smith

Peter Smith

Peter Smith