- Gold (XAU) Catches Fire as Uncle Sam's Credit Gets Dinged

- Moody's Drops the Hammer on America's AAA Rating

- Market Jitters Give Gold (XAU) Even More Juice

- Goldman Sachs Still Super Bullish on Gold (XAU)

- Other Precious Metals Play Second Fiddle to Gold (XAU)

- What's Next for Gold (XAU)? More Upside Ahead

Gold (XAU) went on a tear Monday, shooting past $3,229 after Moody's threw a curveball by downgrading America's credit rating—talk about a wake-up call for investors.

Gold (XAU) Catches Fire as Uncle Sam's Credit Gets Dinged

Well, that escalated quickly. Gold (XAU) had itself a pretty solid Monday, jumping 0.9% as investors scrambled for safe havens after Moody's basically told the US, "Hey, your credit's not as rock-solid as we thought." Nothing like a credit downgrade to get people nervous about their money.

Spot gold (XAU) climbed to $3,229.51 an ounce by the afternoon, while US gold futures did even better, settling up 1.5% at $3,233.50. Meanwhile, the dollar took a bit of a beating, hitting its lowest point since May 8. When the dollar gets wobbly, gold tends to look pretty attractive to folks holding other currencies.

Moody's Drops the Hammer on America's AAA Rating

So here's what happened: Moody's went ahead and knocked the US down from its pristine "AAA" rating to "AA1" on Friday. Their reasoning? America's got way too much debt piling up, and those interest rates are through the roof compared to other countries with similar ratings. Ouch.

This downgrade basically handed gold bulls everything they needed on a silver platter. When people start questioning Uncle Sam's ability to pay his bills, they tend to run straight to gold's warm embrace.

"Overall, over the next few months, I think gold is a good safe bet considering the downgrade on the United States. It's still to me a buy-and-hold market," said Bob Haberkorn from RJO Futures. The guy's basically saying what a lot of traders are thinking right now.

Market Jitters Give Gold (XAU) Even More Juice

As if the credit downgrade wasn't enough drama for one week, Treasury Secretary Scott Bessent decided to stir the pot on Sunday. He announced that Trump's planning to hit trading partners with those tariffs he's been threatening—unless they start playing nice at the negotiating table.

This little bombshell didn't exactly calm anyone's nerves. Wall Street's major indexes took a tumble during Monday's session, with investors clearly feeling a bit queasy about what's coming next. Between the credit downgrade and tariff threats, it's no wonder people are reaching for gold (XAU) like it's the last life preserver on a sinking ship.

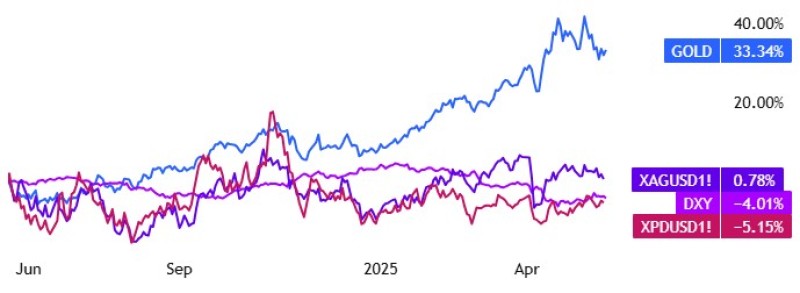

Gold's been absolutely crushing it this year, racking up a jaw-dropping 23.1% gain and hitting one record high after another. When markets get this choppy, gold's like that reliable friend who's always there when you need them.

Goldman Sachs Still Super Bullish on Gold (XAU)

Even with gold already sitting pretty at these levels, Goldman Sachs isn't backing down from their bold predictions. They're still calling for gold to hit $3,700 by year-end and a whopping $4,000 by mid-2026. Their reasoning? Not nearly enough people have jumped on the gold bandwagon yet.

Think about it this way: if Goldman's right, we're still in the early innings of this gold rally. They're betting that both big institutions and regular folks are going to pile into gold as they realize it's not just shiny jewelry—it's serious portfolio insurance.

Other Precious Metals Play Second Fiddle to Gold (XAU)

While gold (XAU) was stealing the show, its precious metal cousins had a more modest day. Silver (XAGUSD1!) managed a tiny 0.3% bump to $32.36, while palladium (XPDUSD1!) did a bit better with a 1.1% jump to $998.26.

Platinum (XPTUSD1!) had the best day among the supporting cast, rising 1.4% to $974.50. Apparently, the World Platinum Investment Council dropped some good news about Chinese demand for platinum jewelry bouncing back after a decade in the dumps. Who knew the Chinese were getting back into platinum bling?

What's Next for Gold (XAU)? More Upside Ahead

From a technical standpoint, gold's looking pretty darn solid right now. The fact that it's holding strong above $3,200 and pushing into uncharted territory shows there's some serious buying power behind this move.

The fundamentals are lining up nicely too. You've got the US credit downgrade, a wobbly dollar, and enough geopolitical drama to keep a soap opera writer busy for years. All these factors are creating the perfect storm for gold (XAU) to keep climbing.

Traders are keeping their eyes glued to anything related to US fiscal policy, what the Fed might do next, and how those trade negotiations play out. Any of these could send gold rocketing even higher—or bring it back down to earth.

With Goldman Sachs throwing around those ambitious price targets and everything else that's going on, plenty of analysts think gold (XAU) is just getting warmed up. We might be looking at even crazier highs before this year's over. Buckle up—it's going to be one wild ride.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah